Decentralized finance is a new blockchain development industry that has gained immense popularity in recent years. The reasons for DeFi’s popularity lie in the availability of these tools to any Internet user, in confidentiality, and the ability to work with financial tools: exchange, landing, borrowing, etc. By using these tools, any user may multiply their crypto assets.

The process of obtaining crypto tokens through interaction with DeFi protocols is called yield farming. Usually, this refers to liquidity mining on decentralized exchanges, where users receive project tokens for providing liquidity to the pool. This also includes participation in lending and farming protocols, as well as staking tokens for a reward.

Yield farming is an interesting concept for users because it allows them to use their crypto assets to get new ones (and receive commissions on trades). It is also an interesting concept for crypto projects because it enables them to solve several tasks, from creating liquidity to regulating the number of tokens in circulation. In exchange for participation in liquidity programs, projects reward users with tokens and a percentage of fees since their economies depend on it.

There are two solutions currently on the market that allow anyone to implement and participate in yield farming. The first solution is the independent creation of contracts and tools by developers, which requires high qualifications and security audits to protect user tokens from hackers. The second solution is the use of dedicated farming platforms, which offer ready-made tools for solving these tasks.

What problems do dedicated farming platforms solve?

Distributing the platform’s native tokens via farming is a transparent and organic process beneficial for both users and the platform. Consequently, the development of blockchain ecosystems implies the creation of services that can solve the problem of increasing liquidity universally.

Dedicated farming platforms for users

Firstly, it is a convenient tool for finding yield farming programs on one platform. Users can find many opportunities that offer cryptocurrency rewards for providing liquidity, as well as other initiatives.

Secondly, it is a matter of trust and reliability. Dedicated farming platforms are more likely to take care of the safety of users and pay more attention to finding and eliminating drawbacks of contracts since this is their main activity and task.

Dedicated farming platforms for developers

Building farms from scratch is a time-consuming technical endeavor. Not every project can create its own platforms for yield farming, and this is not just due to technical difficulties. Therefore, universal ecosystem products that can provide service for multiple projects have a range of benefits, from the ease of use to audience and cumulative value.

Developers do not waste time, effort, and money creating personal yield farming tools because these are already available and tested by the market. This is especially true for security because, as practice shows, even well-known large companies sometimes make mistakes in smart contracts, which are then exploited by fraudsters.

An equally weighty argument is the large user base of such platforms, which almost always exceeds the audience of a single project. Thus, the presence of project programs on dedicated farming platforms can attract more new users. This advantage also makes it easier to find and increase the liquidity of the project.

Dedicated farming platforms push the farming experience further. They give users multiple options to participate in yield farming in one place and provide developers with tools that allow them to focus on product development rather than on creating and validating smart contracts for farming.

One such yield farming service in the Tezos ecosystem is Crunchy.network, which we’ll talk about today.

What’s special about Crunchy?

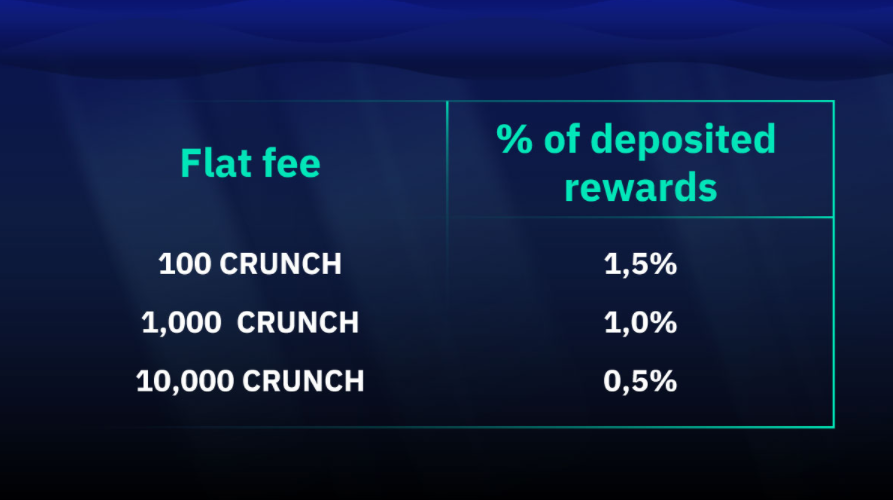

Crunchy.network is a second-generation farming platform. The developers describe their project as DeFi-as-a-Service. Crunchy.network provides projects interested in distributing their tokens via yield farming with the corresponding toolkit, so they don’t have to code their own farms from scratch. In return, Crunchy charges them a flat fee on deposited reward tokens. The fees are paid in CRUNCH tokens.

Crunchy also provides a variety of tools that help projects regulate their economies and keep them in check. We will talk about these tools and their use cases in the next section.

Crunchy tools

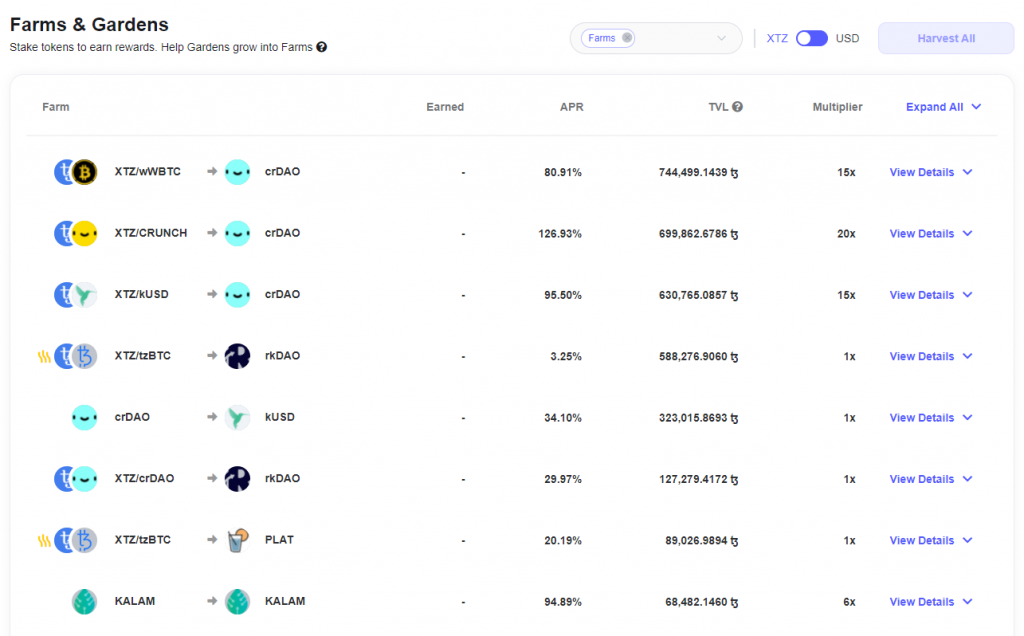

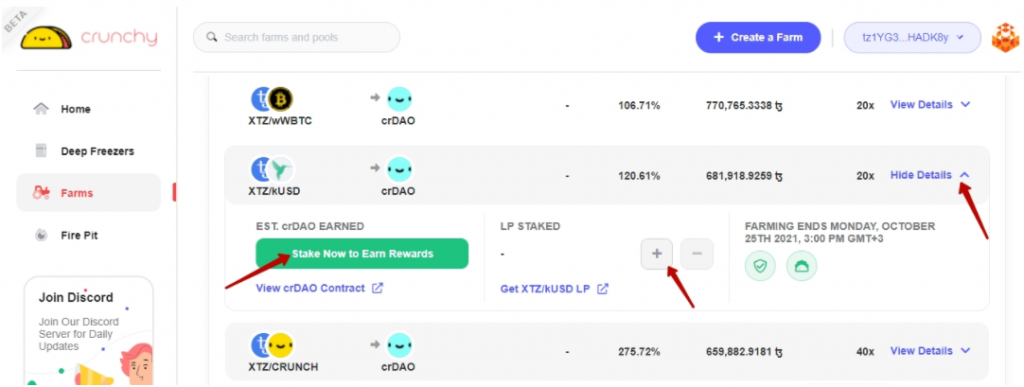

Farms and Gardens: Crunchy currently runs native CRUNCH farms for CrDAO farming. It also provides tools for other projects to start yield farming with their own reward tokens with custom timers, bonus periods, and other settings. Crunchy Gardens are not separate products; they are just smaller Farms with TVL less than 10,000 XTZ.

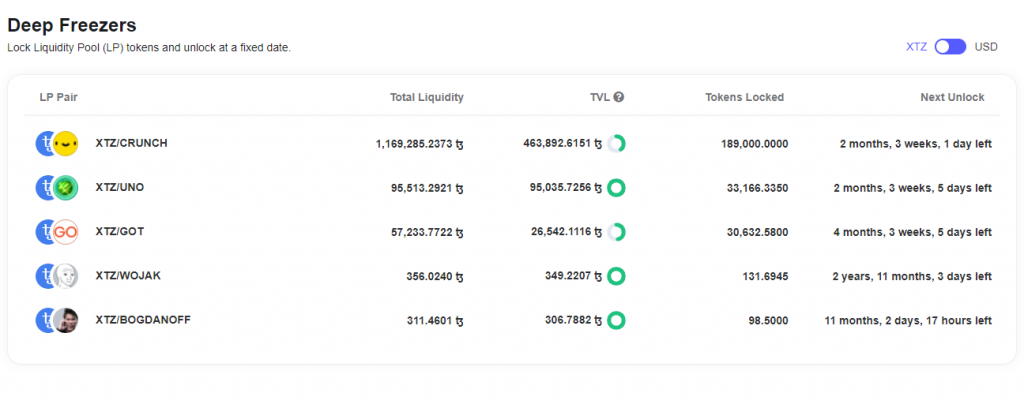

Deep Freezers (previously Meat Lockers): Deep freezers allow developers to lock their liquidity pool (LP) tokens for a specific time. Until the expiration date, tokens cannot be sent or removed from the liquidity pool. This feature can be useful for new liquidity pools so that users can take part in trades more securely and buy tokens with less fear of high volatility.

To create a deep freezer, Crunchy charges a flat fee + % of LP tokens locked. You may choose to burn more CRUNCH in exchange for a lower % fee.

Slow Cookers are vesting contracts that allow project owners and developers to lock XTZ funds or tokens for a specified period and then slowly release (unlock) them on a schedule. Often teams lock their own tokens on vesting contracts to increase the trust of the community, convincing them that they are not going to sell assets in the early stages of the project’s existence, which could have a strong impact on the price.

Pie Slicer: It essentially allows NFTs to be “sliced” into fungible FA2 tokens. The NFT is sealed away in a vault, and the FA2 tokens (slices), representing fractions of the NFT, are returned to the wallet.

Blender: It combines several assets in specific ratios (according to the recipe) into a brand new FA2 token.

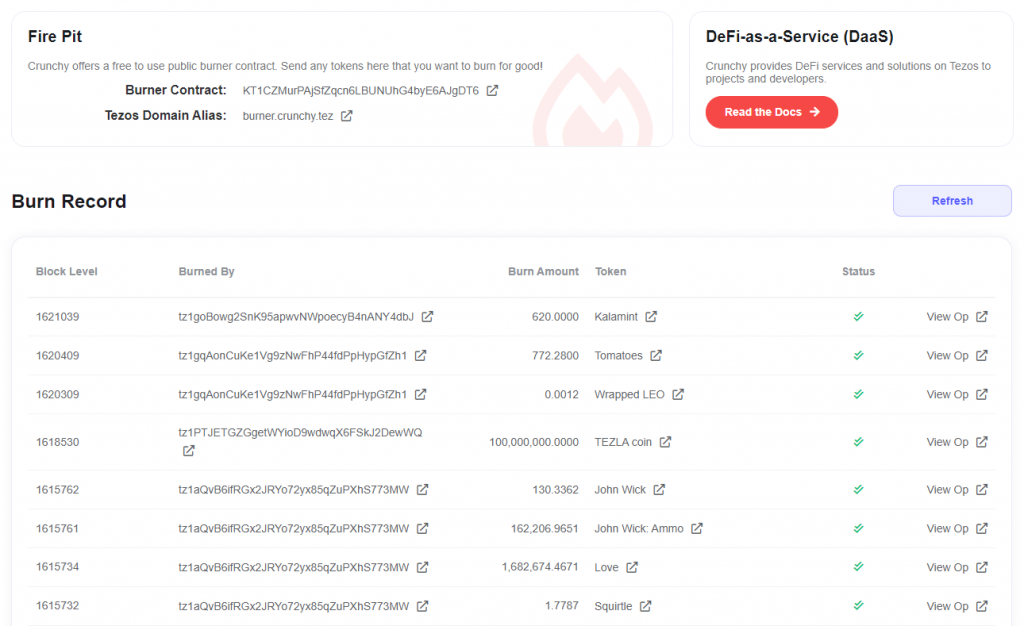

Fire Pit: Crunchy offers a free-to-use public burner contract. Users and project members can send any tokens to a special contract to burn them, reducing the circulating supply.

Some of the tools are still in development and will be released in the future. For example, Crunchy knowledge base also mentions Egg Timer, which is, basically, a DEX order book where bots will fulfill user orders at set prices.

Tokenomics

Crunchy has two types of native tokens:

CRUNCH (KT1BHCumksALJQJ8q8to2EPigPW6qpyTr7Ng) is the platform’s utility token.

crDAO (Crunchy DAO KT1XPFjZqCULSnqfKaaYy8hJjeY63UNSGwXg) is the governance token.

CRUNCH

CRUNCH’s main function is the paying of fees on the Crunchy platform. CRUNCH has a finite supply of 100 million tokens.

- 26% of CRUNCH token’s overall supply was sold during private and public presales.

- 19% was locked as bootstrap liquidity.

- 15% went to the development fund.

- 40% was reserved for user incentives.

CRUNCH tokens are used to start new farms, use deep freezers, and more. To do these things, a project has to pay a flat fee + a cut from the deposited reward tokens. DeFi projects using Crunchy can burn extra CRUNCH tokens as a flat fee to permanently lower the percentage.

NCH tokens can also be used to farm crDAO.

crDAO

crDAO tokens are used in Crunchy DAO governance. crDAO holders will be able to vote for all sorts of changes, from fee sizes and DAO funds distribution to additional crDAO issuance.

Currently, crDAO’s max supply is only 12,000.

How to start farming

To farm on Crunchy, you need to go through several simple steps.

- Check the Crunchy farming page and pick the token pair you want to farm.

- Use QuipuSwap to provide liquidity to the token pair.

- Go back to the Crunchy farming page, click the corresponding farm, and stake LP tokens.

- Harvest rewards as often as you want. Check the “Harvest All” button to get farming rewards for all of your pairs.

When farming a single token, you don’t need to provide liquidity on a DEX. You only need to purchase the token and directly stake it on the Crunchy farming page.

State of affairs and future plans

Currently, Crunchy boasts almost 8% share ($2 million) of QuipuSwap’s TVL. Overall, Crunchy.network farms’ TVL has reached $13 million. Over $1,6 million is currently locked in Crunchy Deep Freezers.

Right now the main farms (with over $2.2 million TVL) are XTZ/CRUNCH, XTZ/kUSD ($2 million), and crDAO ($1 million). Projects like Kalamint and Bazaar, NFT marketplaces, have $260,000 and $58,000 TVL on Crunchy, respectively. Notably, Salsa DAO has set up a farm for XTZ/sDAO farming SPI (Spicy), the upcoming Salsa DAO’s DEX’s native token.

By Q3 2021, Crunchy developers are planning to open Deep Freezers and Slow Cookers for public use, as well as implement other financial incentives for users (mini-games, lotteries), as stated in the project’s roadmap. Next up are Pie Slicer and Blender services. In Q4 2021, crDAO farms will close, and Crunchy DAO will be formed, putting the governance in the hands of crDAO holders.

Conclusions

Crunchy aims to provide a range of services that every blockchain ecosystem can work on. Tezos is no exception. Tezos’ time as a platform for dApps and smart contracts is just beginning, and ecosystem products such as Crunchy can accelerate the adoption of the Tezos philosophy.

However, it is worth remembering that dedicated farming platforms in general, and Crunchy in particular, are available to absolutely everyone, like any decentralized open platform. Along with quality projects, there may be some programs by scammers or developers whose purposes are to attract other people’s assets and not to develop the project. You should carefully study the projects in whose farming programs you are going to participate, weigh all the pros and cons, and consult with experts if your qualifications are not sufficient to make such decisions.