In the previous article, we wrote about yield farming, how this strategy for increasing crypto-assets became popular, and what risks it carries. If you are new to this topic, we advise you to read this article. Today we will talk about the programs and protocols that allow you to farm in the Tezos ecosystem.

The capitalization of the DeFi sector in the Tezos ecosystem is about $100 million. So far, almost 20,000 smart contracts have been deployed on the Tezos mainnet, according to Better Cal Dev. However, these numbers are still very small, which indicates that DeFi on Tezos is just beginning to develop. Keeping in mind the dynamics of the Ethereum network, where approximately $80 billion are already locked in the DeFi sector, we can expect a rapid increase of these numbers in Tezos.

Yield farming is one of the top drivers of capital migration to DeFi. We have listed a few of the main Tezos dApps that enable users to participate in profitable farming below.

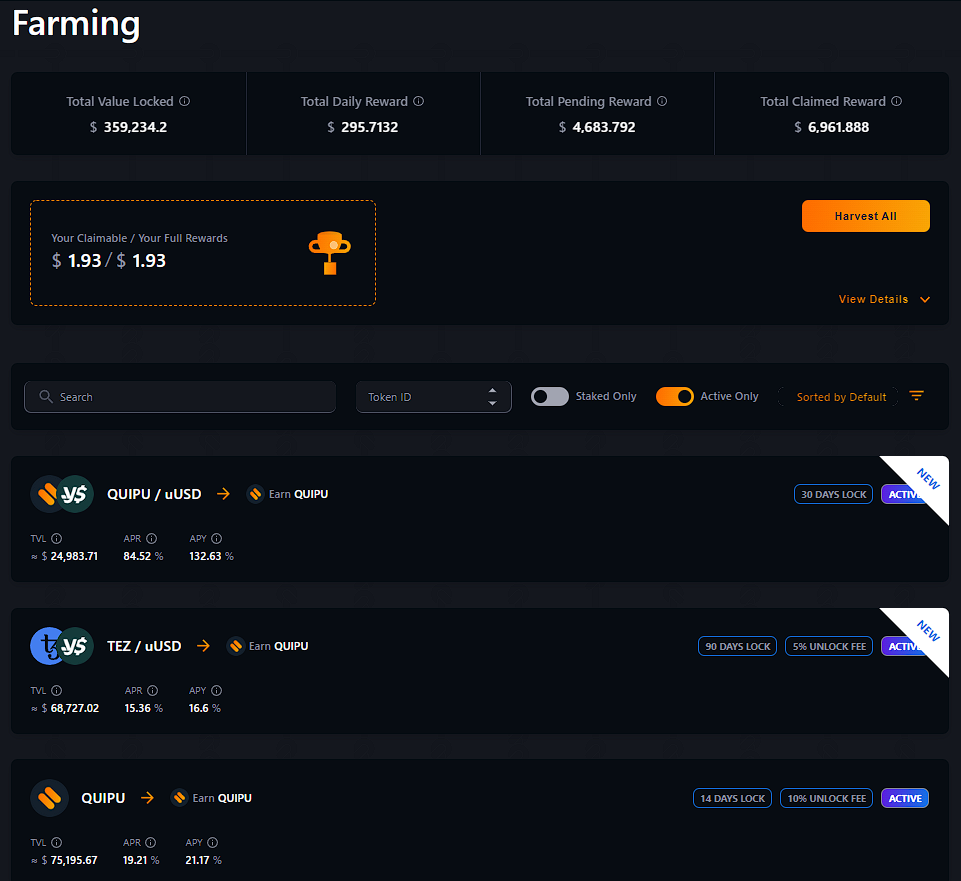

QuipuSwap is one of the most popular DEXs in the Tezos ecosystem. Along with swaps, liquidity providing, and TEZ delegation, QuipuSwap offers farming opportunities. Users can stake their LP from selected liquidity pools or stake a single QUIPU token to earn rewards in QUIPU.

The farming section of QuipuSwap contains cross-farms with other projects from the Tesos ecosystem, and after the cross-chain bridge launch, it will be also possible to participate in cross-chain farming with different blockchain platforms.

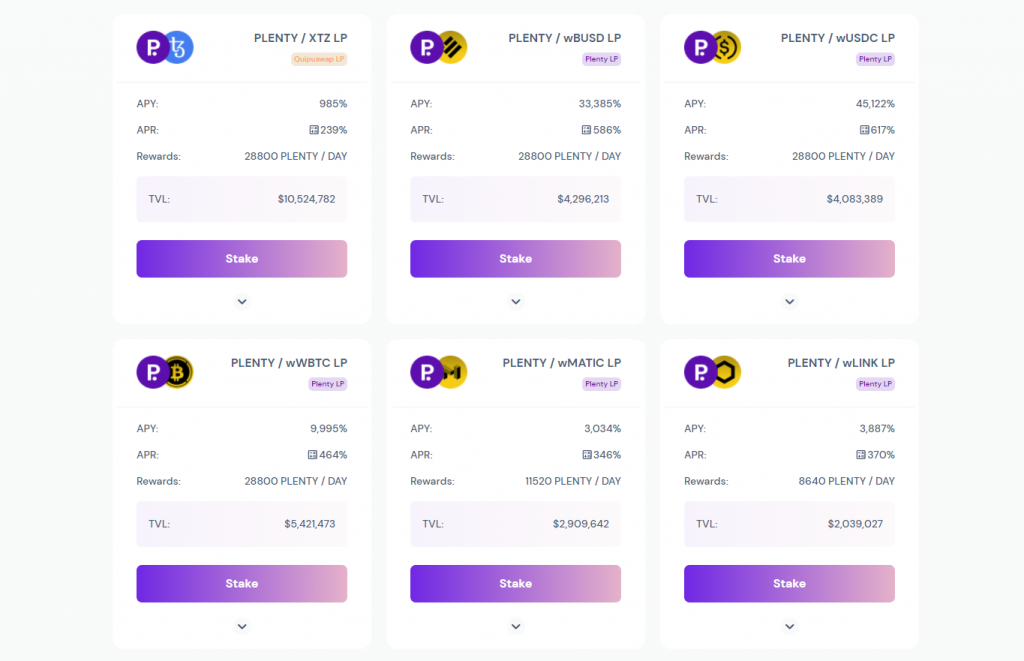

Plenty DeFi is a young, decentralized yield farm protocol and token-to-token DEX in the Tezos ecosystem with over $45 million locked in smart contracts. The project has its own token, which is traded on QuipuSwap and Plenty. Plenty Defi currently offers two yield farming strategies:

- Liquidity mining for LP-providers

- Stake PLENTY and earn tokens

In available farming programs, you can use the LP-tokens received to provide liquidity on Quipuswap or Plenty.

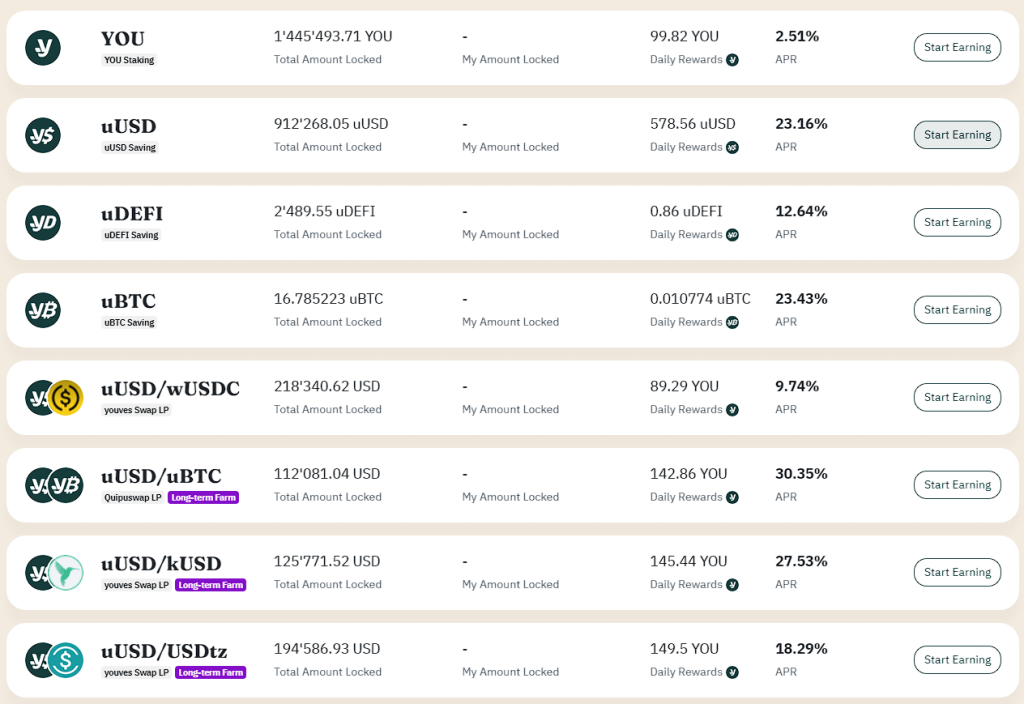

youves is a platform for the creation and management of synthetic assets. Protocol’s participants can mint stablecoins, earning YOU, the governance token of youves. YOU holders have voting rights and the possibility to stake YOU tokens and receive their share of the platform profits.

Before participating in some farming programs with the required token pairs, you should first provide liquidity in the corresponding tokens to receive LPs. Use the hints in the youves interface to determine what assets you need to start farming.

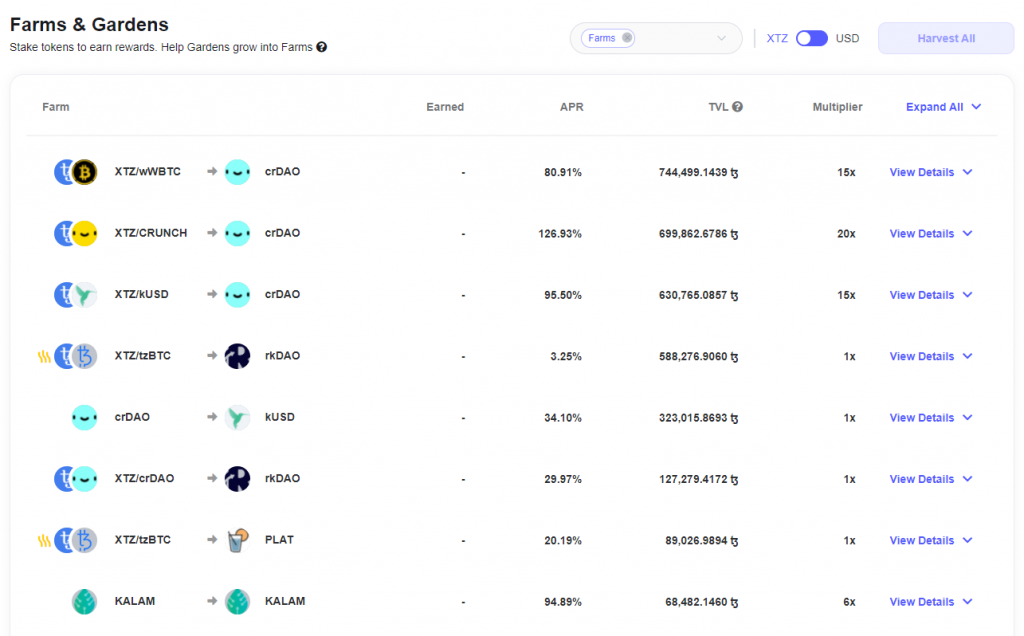

It is a platform for developers and users that offers versatile tools for liquidity management and yield farming. Instead of creating and testing their own contracts, developers can use ready-made contracts for staking, yield farming, and other activities that encourage users to provide liquidity.

For the user, this platform is a convenient aggregator of farming programs, which allows anyone to study the conditions and indicators of various instruments in one place and make investment decisions.

Currently, over $13,260,000 (ꜩ 3,612,000) worth of funds are locked in the farming programs on Crunchy Network, and 16 farms from various DeFi projects are available.

You can read a full review of the Crunchy Network on our blog.

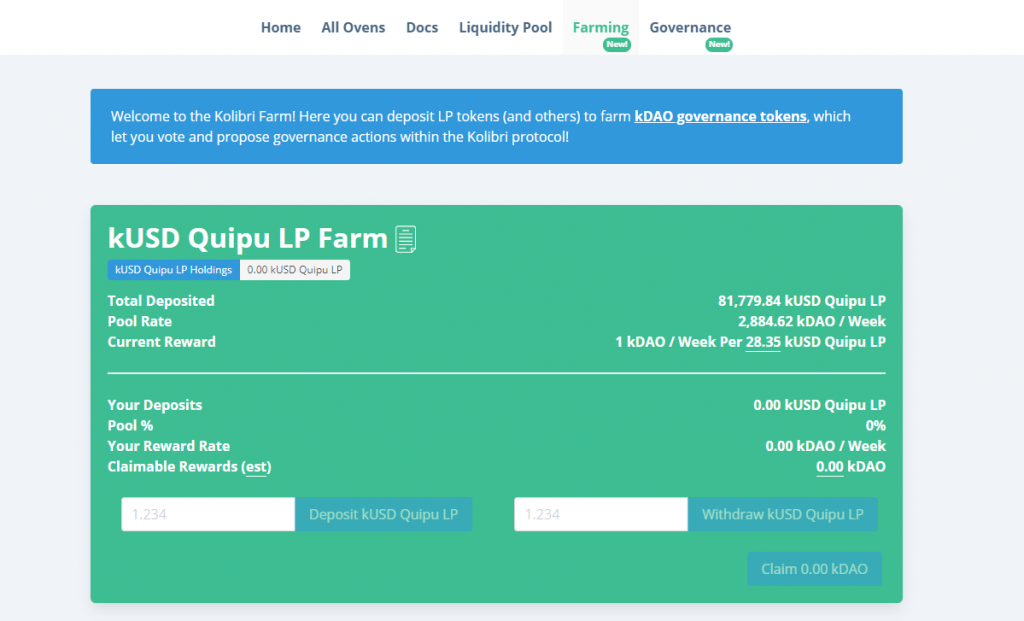

The Kolibri stablecoin was launched in January 2021 and is currently one of the most successful projects in the Tezos ecosystem. Kolibri relies on a set of smart contracts and collateral to withstand price fluctuations. Each new deposit creates an oven, or Collateralized Debt Position (CDP), that allows users to deposit, withdraw, borrow, and repay.

The Kolibri Liquidity Pool issues QLkUSD tokens in exchange for deposits of kUSD tokens in the pool. With QLkUSD tokens, you can claim extra kUSD from liquidating ovens. After liquidation, the pool trades the leftover XTZ for kUSD on QuipuSwap and distributes them proportionally among all holders of QLkUSD tokens.

Kolibri also includes several farming programs:

- The kUSD Quipu LP farm allows you to deposit Quipuswap XTZ/kUSD LP Tokens and farm Kolibri Governance Tokens (kDAO).

- The kUSD farm allows you to deposit kUSD and farm Kolibri Governance Tokens (kDAO).

- The QLkUSD farm allows you to deposit Kolibri Liquidity Pool Tokens and farm Kolibri Governance Tokens (kDAO).

You can read a full review of Kolibri on our blog.

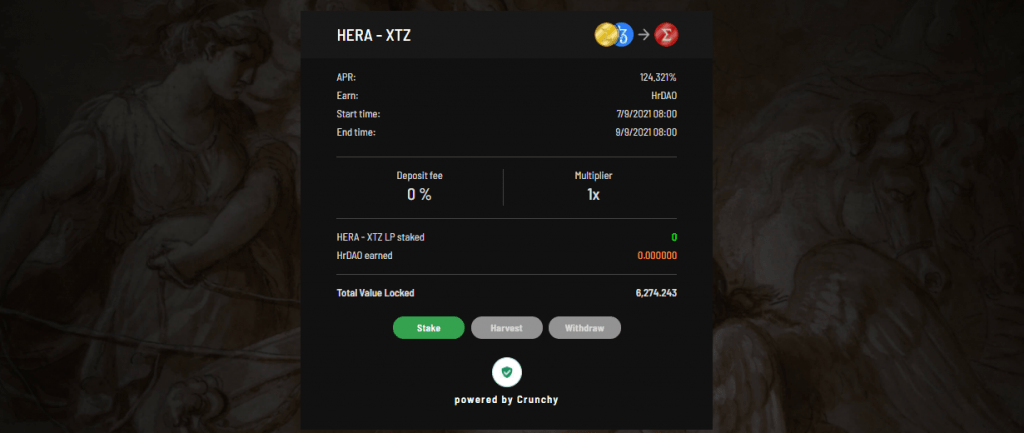

This platform in the Tezos ecosystem integrates a calendar of events for the Tezos community and provides p2p betting, p2p lottery, yield farming, and plans to launch a decentralized AMM protocol.

Users receive the governance tokens hrDAO and HERA in exchange for their participation in yield farming programs by providing liquidity.

How to Participate in Yield Farming

To show an example of yield farming in the Tezos ecosystem, we present an instruction video “How do I Start Farming on QuipuSwap?”, which step by step describes the process of participating in QuipuSwap’s farming programs.

Prospects

The dynamics of the use of smart contracts in the Tezos ecosystem are impressive. Over the past months, the frequency of calls to contracts has increased more than six times. TVL across the various Tezos blockchain protocols shows the same dynamic, confirming the start of the “DeFi season” in this ecosystem.

In addition, on August 6, 2021, the Granada update was released to the network, which brought down the block formation time by 50% and significantly reduced gas consumption in smart contracts. This update made the Tezos ecosystem even more interesting and beneficial to DeFi applications, which means their numbers will continue to grow.

Along with this, the number of yield farming programs will also increase, attracting more liquidity and users to Tezos.