Yield farming is the strategy of using crypto in DeFi protocols to get even more crypto. Unlike speculative operations where the multiplication of assets is carried out through buy and sell operations, yield farming is more like traditional farming where the user “grows” new assets (harvests), “locking” crypto in protocols and smart contracts (soil).

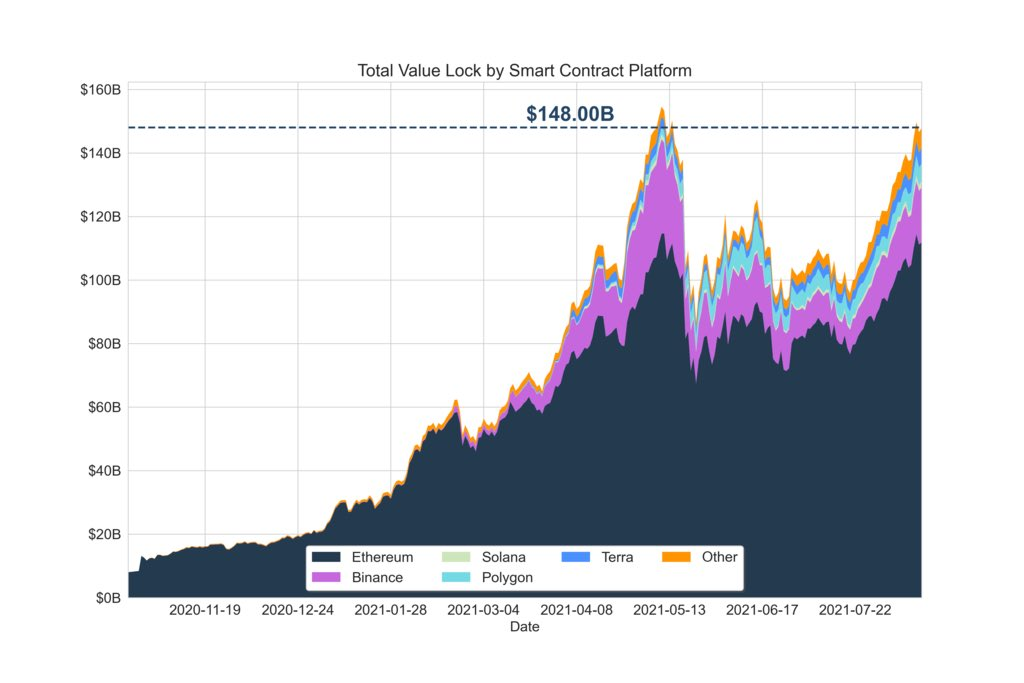

This opportunity was presented to the crypto community by Decentralized Finance, a young and very popular blockchain direction. DeFi’s availability to all categories of users, its censorship resistance, and its variability of use have increased this sector’s capitalization a hundred times over. Within the past 1.5 years, the value of assets locked on smart contracts for DeFi applications has exceeded $148 billion.

Global DeFi adoption has been accelerated by yield farming tools which provide users with new investment opportunities in the crypto space. Broadly speaking, yield farming is the process of interacting with DeFi applications in return for receiving cryptocurrencies. According to Coingecko, the estimated returns on popular yield farming pools range from 1.15% to more than 1000% APY (Annual Percentage Yield).

Essentially, this is a set of investment strategies in the DeFi sector, not a single strategy or a “to-do list” for crypto holders. In this article, we will consider yield farming from this point of view and, of course, we will talk about all its current uses on the market. But to gain a complete understanding of this process and the reasons for its emergence and popularity, we need to start by looking at its history.

History of Yield Farming in DeFi

The beginning of yield farming’s popularity and spread is associated with one of the first (and still very popular) DeFi projects, Compound Finance. It was one of the first well-known DeFi applications that had a notable impact on the development of the industry as a whole. The Compound is a decentralized lending protocol that specializes in loans and borrowing in cryptocurrencies.

In the summer of 2020, Compound decided to implement decentralization in the protocol’s governance and began rewarding liquidity providers with an internal token, COMP. This token gives holders the right to vote and make decisions on the protocol. The market’s reaction was extremely positive: many users provided their assets to the protocol in exchange for tokens. This made Compound Finance one of the most popular DeFi protocols, and for a long time, it was the leader among all dApps in terms of capitalization.

In turn, this demonstrated the market’s interest in using its available assets to get new ones, a process which we now call yield farming. Following Compound, hundreds of other projects have started using this approach, attracting liquidity and distributing rewards to its providers. The participants in this process received a meme-worthy name: yield farmers.

It has become a versatile and working tool to encourage initiatives to provide liquidity in decentralized protocols. This allows dApps to fully function, keep the market for their token liquid, and regulate their circulating supply. In addition to Compound Finance, the undisputed leaders in the current DeFi industry are:

Aave (Multichain)

Aave is an open-source, non-custodial liquidity protocol that can be used to borrow assets and earn interest on deposits. Depositors provide liquidity to the market to earn passive incomes, while borrowers can borrow these funds with cryptocurrencies as collateral. This project appeared in early 2020 and has become one of the most successful in the DeFi sector.

The AAVE governance token can be staked within the protocol Safety Module. This protects Aave from a lack of available reserves to repay loans. Stakers earn staking rewards in tokens and fees from the protocol.

Uniswap (Ethereum)

Uniswap is one of the first (and most popular) decentralized cryptocurrency exchanges to use AMM. Founded by Hayden Adams in 2018, Uniswap is the main Ethereum-built DEX at the moment, with a TVL (total value locked) over $2.6b and daily trading volumes over $1.2b.

Uniswap’s automated market making is based on liquidity pools, where users can add their assets and receive commissions from transactions and LP-tokens. These tokens confirm their share in the total pool. In exchange for LP-tokens, projects are willing to give rewards, including their own tokens.

Curve Finance (Multichain)

Curve is a decentralized exchange liquidity pool on Ethereum, designed for stablecoin trading. Curve was launched in January 2020 and has become the largest stablecoin marketplace. There are currently seven liquidity pools in the protocol: Compound, PAX, Y, BUSD, sUSD, ren, and sBTC. Liquidity providers transfer their assets to these pools and make revenue.

Yield Farming Vaults

The next step forward in the development of yield farming ideas was the so-called “vaults”. DeFi vaults work like pools of assets that apply multiple strategies to maximize profits using the provided assets. However, vaults not only supply user assets to various farming programs, but they also solve several other tasks, including:

– Supplying collateral;

– Borrowing other assets;

– Providing liquidity;

– Collecting trading fees;

– Farming other tokens and selling them.

DeFi vaults also withdraw accrued interest automatically and reinvest these tokens to maximize income.

The first to introduce and implement “vaults” technology was Yearn.Finance, the project of the well-known Andre Cronje. Yearn.Finance is now one of the top 10 DeFi applications in terms of capitalization, and the price of the YFI token is comparable to that of Bitcoin. The popularity and success of Yearn.Finance was brought about by automation, which removed much of the routine work for users.

Most Popular Yield Farming Options

To get a complete picture of “How Yield Farming Works”, we need to take a look at the most common DeFi protocols participation models that can be attributed to yield farming.

The set of strategies, called yield farming, is being used to solve the main problem of decentralized finance – lack of liquidity. Liquidity is the ability of an asset to be sold in the market quickly. In traditional centralized finance, this problem is solved by reserve funds, brokers, and custodian institutions. But in decentralized finance, the task of creating liquidity lies with the community.

To incentivize the community to actively provide available assets to liquidity pools, DeFi protocols reward users with a percentage of fees, as well as crypto tokens.

Where and how can you use yield farming to multiply your crypto assets?

Providing Liquidity and Liquidity Mining programs

You already know how DEXs work with asset pools. To start trading a cryptocurrency pair, for example, XTZ/wUSDT, both assets must be provided to the pool in proportions that correspond to their market prices. For example, a user adds 100 XTZ and 300 wUSDT to the pool on Uniswap if the price of 1 XTZ = $3.

Furthermore, when users of the exchange make transactions in the XTZ/wUSDT pair, a % of commissions from each transaction is distributed between liquidity providers in proportion to their share in the pool. The user also receives an LP token, which indicates their participation in the liquidity pool. This token can be used in liquidity mining programs on protocols to get more tokens.

The idea behind Liquidity mining is to reward users for providing liquidity, not only with fees but also with internal tokens. Such programs are used by project developers to entice the community to increase the liquidity of their tokens on decentralized exchanges or protocols.

For example, Project X issues its own tX tokens, then invites users to add funds to a liquidity pool on a decentralized exchange. The received LP-tokens are offered to be sent to the contract of the project liquidity mining program. Participants will receive new tXs as a reward. APY might vary according to the offer/demand balance on the market.

Lending Protocols

Decentralized lending and borrowing protocols allow the community to lend their assets as deposits and take collateralized loans from pools at an annual interest rate. Users who provide liquidity to such protocols and lend their assets to other users receive a percentage of the income. In addition, some of the lending protocols reward users with tokens, which may be: used to manage the protocol’s governance by voting, sold on the market or used in any other yield farming strategies described in this article.

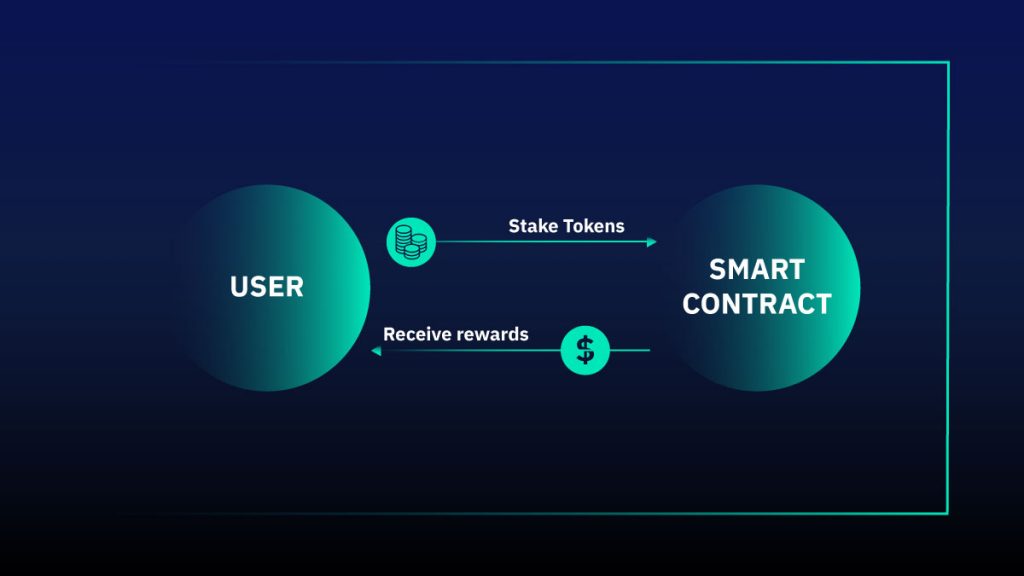

Staking Programs

Staking in DeFi is the process of locking crypto assets in smart contracts for a profit. Unlike liquidity mining, participation in staking does not require the provision of two types of assets to the liquidity pool. Staking performs the opposite task: it “freezes” tokens for a long time so that holders do not sell theirs for speculative purposes. This reduces the circulating supply, protecting token prices from sellers’ pressure.

Staking is the easiest way to participate in yield farming since it requires only one asset type and provides the user with passive rewards. Moreover, staking is devoid of the risks of impermanent losses, one of the biggest problems of decentralized finance, which we will discuss below.

Risks and Potential Dangers of Yield Farming

Despite its apparent simplicity, yield farming involves many risks and is recommended only for experienced users. Participation in yield farming requires a complete understanding of what you are doing in order to minimize the risk of losing funds. Let’s talk about the key risks of participating in yield farming in Defi Protocols.

Vulnerability of smart contracts. Even if an honest team developed a contract that did not hide loopholes for withdrawing users’ funds for fraudulent purposes, there could still be bugs. For reliability purposes, contracts need a deep audit from professionals. Since DeFi-developers are often groups of enthusiasts, they do not necessarily have large budgets for checking and auditing contracts, which leaves them open to potential attacks by hackers. In addition, even an audited contract is not immune to vulnerabilities and shortcomings.

Developers of farming programs may be scammers who are not engaged in the development of the project but are only interested in attracting other people’s funds. Therefore, you should always take the time to learn about the project. Investigate what is behind it and whether the project has a working economic model.

The DeFi sector has no legal regulation. This industry is not regulated by any laws or financial rules. If users lose funds or get into an unpleasant situation due to poor quality services provided by DeFi projects, they will not be able to obtain legal assistance. Even depositing and withdrawing funds through bank accounts becomes difficult, as does tax reporting.

Impermanent Losses. Impermanent loss is the situation where the deposit provided by the user to the liquidity pool will differ from the initial deposit at the time of withdrawal. This is due to the liquidity of assets, where the price of one asset in the pool changes relative to the price of another. AMMs automatically balance the ratio of assets in a pool and calculate their prices using the formula X * Y = K, where X and Y are two different assets, and K is a constant value that must be the same before and after the transaction.

But how do impermanent losses arise if the amount of funds in the pool remains unchanged, despite the growth in the price of one of them in the market? When a price difference occurs, arbitrage traders come into play. They buy the asset where it is cheaper (in a DEX) in order to sell it on a centralized exchange. This happens until the price of the asset is equal to the market price, due to which the ratio of assets in the pool will change.

You can find more about impermanent losses in this explanatory:

Flash loan attacks. A flash loan attack is a type of DeFi attack in which a user takes out a flash loan (uncollateralized lending) and uses it in combination with various other methods to influence the market. Due to large liquidity volumes, flash loans allow users to change the prices in pools or manipulate other economic incentives in DeFi projects.

Such attacks occur in a matter of seconds and may involve several DeFi protocols at the same time. To date, losses from such attacks have reached several hundred million dollars. Note that it is not necessary to use borrowed funds to manipulate the markets in DeFi protocols, but this is the fastest and easiest way.

Composability. While this feature is considered an advantage of decentralized finance, it may be a double-edged sword. The fact is that when the same platforms and technologies are used by entire project ecosystems, a failure in one of them may lead to problems in the entire ecosystem.

In addition, a distinctive feature, not only of decentralized finance but also of the entire crypto market, is very high volatility. The prices of assets can change by tens or hundreds of percent per day, especially if we talk about tokens of new projects without large capitalization. Such volatility may not only bring large profits but can also lead to significant losses.

Conclusions and Future Perspectives

Now you know what yield farming is, why the industry needs it, and what the most common yield farming strategies are. Currently, the decentralized finance market is one of the fastest and most dynamic markets in terms of development. In one year, many of the described issues may be solved, and we can expect that several new yield farming strategies will have appeared.

One thing is certain – the popularity of yield farming and decentralized finance is growing every year. The number of people involved and the total value locked continues to hit new records. Despite the growing volume and interest in yield farming, users should be aware of the key risks involved and “Do Your Own Research” (DYOR) before participating.

Stay tuned. In the following article, we will share information about the Tezos Yield Farming ecosystem!