You might’ve heard about the loud launch of Uniswap, the decentralized exchange (DEX) that has breathed life into the DeFi concept and reduced the current popularity of centralized exchanges (CEX). This was an important event that occurred in 2020 in the crypto world. If all of these things sound abstract to you, here’s a very simple explanation of what happened.

The basic principle of any CEX is that each transaction (the buying or selling of crypto) needs verification from a third-party platform. A DEX makes this completely unnecessary. How is this possible? Read this overview to understand!

What is CEX?

A CEX involves the presence of a third party that makes transactions happen. Broadly speaking, there’s a centralized mechanism that stores and secures all assets and transactions. Usually, it’s a specific for-profit firm that offers this service. If you want to cash out your cryptocurrency, you should transfer this crypto into a CEX, provide your personal information for verification purposes, and pay a fee for the exchange.

Examples of CEXs

The first and most well-known CEX is Coinbase. This minimalistic trading platform operates like a traditional financial institution. It has two key features: an integrated wallet and an international currency exchange. This platform was successful enough to make its co-founders, Brian Armstrong and Fred Ehrsam, billionaires, according to Forbes list of Billionaires 2021.

Coinbase has been doing well recently. In the first quarter of 2021, it demonstrates impressive numbers:

- Total Revenue of approximately $1.8 billion. It was $190 million for January-March 2020 and $66 million for January-March 2019.

- Net Income of approx. $730-$800 million. It was only $32 million in January-March 2020.

- 56 million Verified Users. Their number increased from 43 million in 2020.

Other examples of CEXs include Binance, Bittrex, Poloniex, and Bitfinex. They work as trustworthy third-party platforms that review and verify transactions.

What is DEX?

DEXs are revolutionary in that they eliminate the participation of intermediaries in the exchange process. Marketplaces are regulated by blockchain mechanisms solely, which allow two parties to participate in face-to-face, peer-to-peer transactions for a minimal fee. These parties remain anonymous since it is not necessary to verify an account before a trade.

Order book vs. AMM

To improve efficiency, DEXs are steadily switching from traditional order book models to automated market makers (AMM).

An order book is a collection of open buy- and sell-side orders for a given financial instrument. In a traditional order book model, buyers and sellers specify their prices, and the transactions happen once they come to an agreement. This emphasises the importance of a token’s liquidity, which in turn depends on both the number of orders as well the effectiveness of covering the imbalance between buyers and sellers.

This model doesn’t work well for DEXs. They have a low volume of orders, and blockchains take too much time to execute transactions. This makes the whole process slow and ineffective, and tokens are likely to become illiquid.

AMM leaves order books behind. This deterministic algorithm facilitates transactions through the use of liquidity pools, where liquidity determines the prices of tokens. In this financial model, each new swap automatically changes the ratio of tokens and sets the new price in relation to the pool size. Only the liquidity pool is able to specify the price — resulting in transactions that happen automatically and quickly, even for assets with low liquidity.

AMM technology is associated with DEXs, but Binance (a CEX platform) sometimes adopts it as well. To learn more about the differences between traditional order books and AMM, read our previous blog post.

Examples of DEX

Even though DEXs and CEXs were developed in parallel, the popularity of the DEX concept is connected to the Uniswap launch. The technology is a finance protocol that accelerates the exchange of cryptocurrency on the Ethereum blockchain. To do this, it utilizes an algorithm that collects, from liquidity pools, information relating to the current supply and demand dynamic between the given tokens. According to DefiPulse, the total value locked in Uniswap is around $6 billion as of April 5, 2021.

Other dApps that serve as DEXs include Sushiswap, 1inch.exchange, dYdX and Balancer. They all rely on smart contracts to execute transactions automatically, without the involvement of a third party..

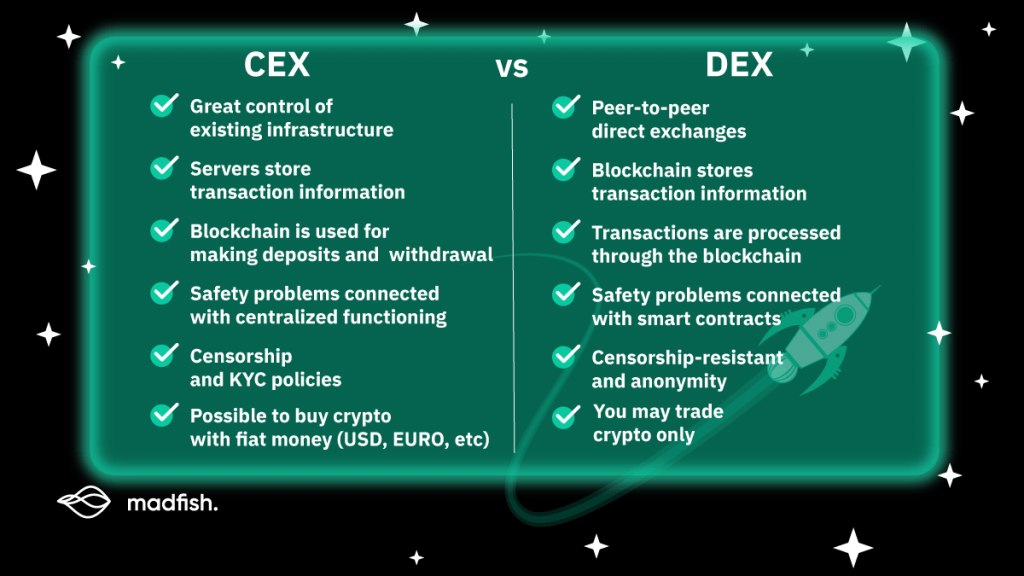

6 Main Differences between DEX and CEX

Difference #1: Level of Centralization

The main features of a CEX are the presence of infrastructure and the level of control offered by the platform. These help ensure the accuracy and efficiency of each transaction. This is done by scanning the data through internal servers and centralized processes.

On the other hand, DEXs enable users to interact directly on the blockchain. Traders are more educated and have total control over their funds. Also, smart contracts eliminate the need to involve third parties in their transactions.

Difference #2: Control over Funds

On CEXs, users delegate control of their funds to a centralized server that stores information about the transactions. This resembles traditional financial mechanisms that blockchain technology should eliminate.

On DEXs, the protocol enables you to set your own rules with a smart contract. This transfers the control of funds back to the transactor, without the need to delegate it to a trusted intermediary.

Difference #3: Security

CEXs and DEXs face different difficulties. Most CEX problems are connected to a centralized server. If a hacker attacks it, they can damage the whole system. At the same time, the established infrastructure protects transactions from fraud.

In the case of a DEX, the hackers cannot attack the central system — it doesn’t exist. However, problems may arise in smart contracts. The programming language may have flaws, and smart contract vulnerabilities may enable hackers to take tokens from liquidity pools. Moreover, full anonymity increases the risk of money laundering.

Difference #4: Liquidity and Trading Speed

In essence, liquidity refers to the ease of converting one asset into another without affecting its market price. CEXs and DEXs have fundamentally different mechanisms that determine asset liquidity.

A CEX provides the benefit of fast trading speeds as its infrastructure doesn’t involve the use of blockchain technology. In addition, the large volume of orders ensures high liquidity.

A DEX uses both order books and AMM, with the liquidity situation changing accordingly. In the case of a traditional order book model, the generally low volume of orders and the involvement of blockchain make the process slow and ineffective. On the other hand, AMM has high liquidity due to automatic liquidity providers that enable instant exchanges, even for illiquid assets.

Difference #5: Censorship Resistance

The CEX platform imposes certain rules and regulations on its participants. It’s common for them to request a legal entity and to collect personal information from their users. KYC practice is another example of censorship on CEXs, where platforms request documents such as national passports and bank statements. Due to strict regulation, a CEX can freeze funds on your account at any time.

Such things are impossible on DEXs as there is no central authority that can block your participation on the blockchain. All traders interact as anonymous transactors, and there’s nobody who requests your personal information.

Difference #6: Ability to Trade Fiat Currencies

One of the remarkable differences between CEXs and DEXs is the number of features available, with the ability to cash out cryptocurrency being the most prominent one. On a CEX, it’s possible to buy and sell fiat currencies. However, DEXs only offer cryptocurrency/cryptocurrency pairings at the moment.

Flaws of DEXs

1. Low liquidity: There is no centralized mechanism that shortens the matching time between tokens on DEXs. This has previously caused liquidity problems. Nowadays, AMMs are used as a tool to increase DEX’s liquidity through automatic liquidity providers that speed up the turnover of assets on exchanges.

2. Smart contracts problems: Generally, smart contracts cause the majority of security issues on DEXs. Malicious users may hack them and withdraw liquidity.

3. Limited features: On a DEX, you cannot exchange cryptocurrency with fiat currency and there are no margin trades. In general, the functionality for traders and the number of orders are limited.

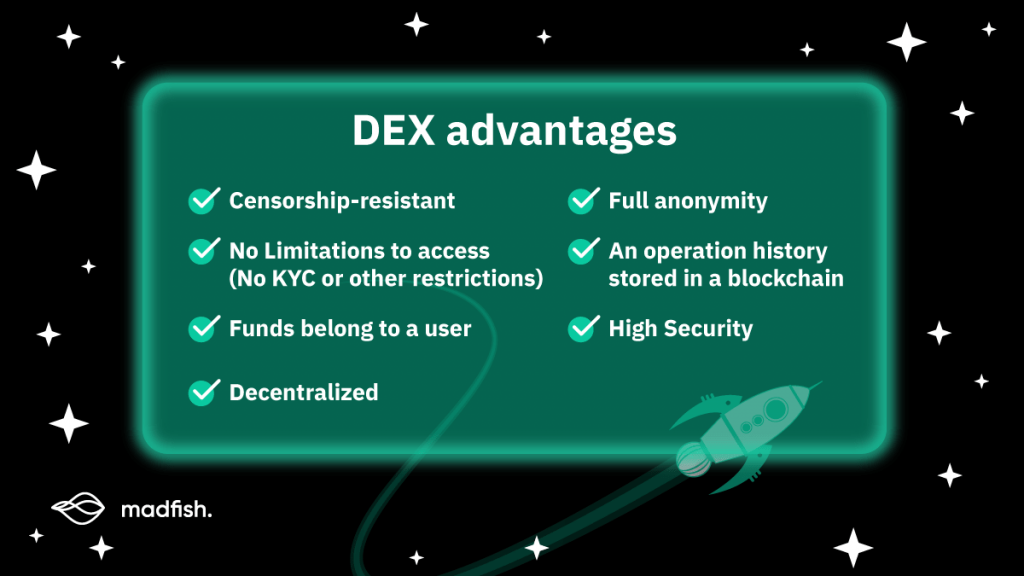

Advantages of DEXs

1. Control over funds: There is no entity outside the blockchain that stores your assets. You participate in direct peer-to-peer transactions using your own funds.

2. Full anonymity: A DEX doesn’t request personal information and has no KYC policy. All the transactions happen in smart contracts and do not require you to reveal your identity.

3. High level of protection: There is no central server that hackers can attack and steal your tokens from. All transaction information is locked in smart contracts.

Who Should Try DEXs?

In essence, a CEX acts as a market player that offers easy-to-use trading mechanisms but that takes control of your funds in return. On this platform, you can enjoy fast trading speeds and high liquidity, together with the opportunity to exchange fiat currency. However, relying on a centralized server has disadvantages: the risk that your funds will be stolen or frozen is much higher when you give them to a third party. Moreover, a CEX may impose high fees for its services.

A DEX provides traders with control. There is no sole repository for storing funds, no data to hack, and full anonymity is guaranteed. With the development of blockchain technology and solutions like AMMs, DEXs are improving their liquidity. They have great prospects. In particular, DEXs have demonstrated a positive trend in solving speed and liquidity problems. They are attractive to traders from regions that are currently left out due to strict market rules as well as those who don’t want to hand over their funds to a central authority.