Yupana.Finance is an open-source, decentralized, and non-custodial lending protocol on Tezos built to securely lend and borrow digital assets via smart contracts.

What is a DeFi lending protocol and why is it lucrative?

DeFi lending protocols are trustless platforms fueled by smart contracts.

They allow lenders to lock assets for others to borrow while accruing interest.

They also allow borrowers to borrow assets with collateral without intermediaries.

Adding liquidity to a lending protocol is considered less risky than many other types of crypto activities. For instance, in trading selling/swapping an asset is by all purposes the same as closing a long position and losing potential future profit. In lending protocols, users may borrow liquidity, without selling cryptocurrency, and use the received funds in other DeFi projects. Thus, users can expand their financial activities without selling their assets.

What is the structure of a Yupana?

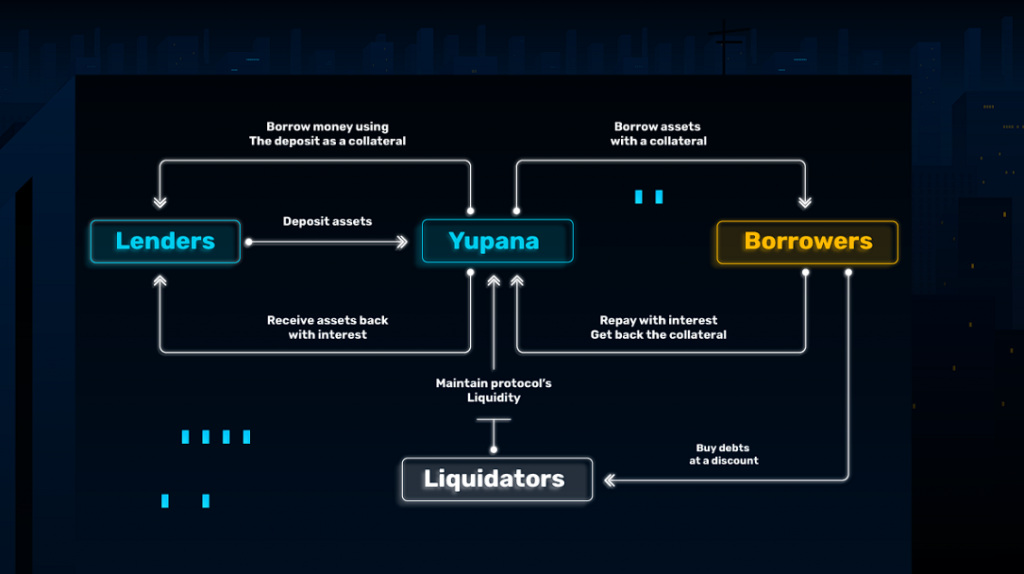

Users of Yupana protocol are divided into three interdependable categories: Lenders, Borrowers, and Liquidators.

Depositors provide liquidity to the protocol, receiving passive income, while borrowers take over collateralized loans. The third group named Liquidators is incentivized to liquidate positions with insufficient collateral and keep the platform running.

To be more specific:

Lenders supply their assets to lending pools and receive an equivalent amount of yTokens (Yupana liquidity shares). yTokens can be transferred as long as they are not used as collateral on the platform.

Benefits/Risks: Lenders earn interest for providing their assets. They can also take loans using their deposit as collateral. Of course, the usual risks like exchange rate swings apply.

Borrowers can directly take a secured loan through the Yupana protocol as P2P lending. To get a loan, the borrower needs to supply assets as collateral more valuable than the loan amount. Collateral rates are specific to each asset.

Benefits/Risks: A borrower can significantly expand his portfolio without selling his assets and missing out on the potential future profit. But there is always a risk of liquidation if the loan is neglected or the market becomes dangerously volatile.

Liquidators close debt positions when collateral value is not properly covering their loan/debt value. In a liquidation, up to 50% of a borrower’s debt is repaid and that value + liquidation fee is taken from the collateral available, so after liquidation, the amount liquidated from debt is repaid.

Tl;dr: Liquidators help to maintain liquidity on the protocol by buying out other users’ debts at a discount.

Benefits/Risks: Liquidators’ earnings come from the liquidation fee on the loan that is no longer considered liquid. Liquidating a lucrative position is not easy though as there will be high competition.

Infographics:

How does it work under the hood?

For Lenders:

Making a deposit is not much different from locking assets in most other DeFi protocols. Locked assets are stored on a smart contract.

APY is determined by the market demand for the corresponding asset and can be seen in the Markets section.

Depositors earn the interest that borrowers pay. The interest depends on the utilization rate (total amount of the asset that was borrowed/total available supply). With a high demand for a loan of the selected asset, depositors receive more income.

The lender’s deposit may also serve as collateral (togglable), which allows it to borrow assets from other users of the protocol at an interest. Thus lenders and borrowers can seamlessly assume both roles.

The deposit can be withdrawn at any time unless it is already used as collateral.

For Borrowers:

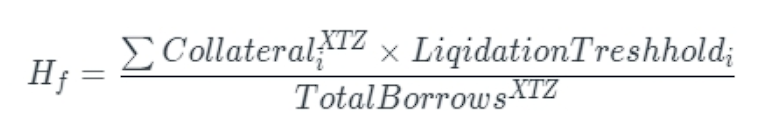

The size of the available loan depends on the size of your collateral and several other variables, like current liquidity in the pool and your health factor.

The health factor shows the safety of your borrowed assets in relation to the value of your deposit. The higher this value, the safer your credit position. When your health factor goes below 1, your assets are liquidated.

The interest rate on a loan depends on a specific asset and is determined by the ratio of supply and demand for the asset. The current interest rates on your active loans can be checked in the Borrowings tab of your dashboard.

Loans have no time limit but rising percentages and exchange rate volatility may change your supply/debt ratio. As a result, your health factor may deteriorate, leading to the eventual liquidation. To avoid liquidating your collateral, you need to keep an eye on your health factor. To increase it, you can partially repay the loan or replenish more assets as your collateral.

For Liquidators:

The liquidation process occurs when another user repays part of the outstanding amount of the borrower and thus purchases his collateral at a discount. Liquidation happens when the margin between the collateral supply and the debt becomes too narrow, the health factor drops below 1 and the loan can no longer be considered sustainable.

Each user can take part in the liquidation by simply closing positions in the Liquidation tab. However, many people want to close someone else’s loan, and liquidators will have to develop their own solutions to liquidate loans and receive bonuses first.

Help us test Yupana!

Yupana is entering the stage of the public beta on testnet. We welcome you to take part in the test pro bono.

Help us make this product better for the mainnet release.

What sort of feedback do we need?

- Acquaint yourself with the UI. Tap buttons, read tooltips, check dashboards, and tell us what we can make better.

- Use the platform. Lend, borrow, liquidate, manage your assets. Report errors or weird behavior. Tell us which features are missing and which can be improved.

- Ask questions. If anything pertaining to the platform’s features and inner workings is not clear enough, it means we can further smoothen the flow of information.

How to send the feedback?

We have a neat Google form for all your bug reports and feature requests:

https://forms.gle/wgwEMASBspnx7BWq9

Or talk to us directly!

https://t.me/yupana_public_testing

If you want to save us time, please make sure your report is unique by consulting with the following table: https://docs.google.com/spreadsheets/d/1vhwAIhP_oc2o0ChGEPWe8jXwRfV_7HZSiPmxp0VrZig/edit?usp=sharing

Where do I get the testnet tokens?

To help us test the platform you will need some testnet tokens. Skip this section if you know how to mint testnet tokens. Otherwise, read on!

First of all, you will need a testnet account.

You can use your existing account but for testing purposes, we advise you to create a brand new wallet. Once you choose your test account, switch the network to Ithaca Testnet.

To start testing Yupana, first of all, you are going to need some testnet Tez.

The easiest way to get testnet Tez is by using a Telegram bot created by the Baking Bad team.

Once you’ve opened the bot’s chat, the process of receiving tokens is very straightforward.

- Type in /start.

- Click the Get Coins button.

- Paste in your test wallet’s address.

That’s all. You now have 100 Tez heading to your testnet account. Rinse and repeat if you need more.

How do I mint other tokens?

At the start of the testing period Yupana will support the following testnet tokens:

cTez, kUSD, tzBTC, uUSD, uBTC and wTez.

There are several ways to get your hands on these tokens. We’ll walk you through each of them.

- Swap tokens on QuipuSwap

For the purposes of testing Yupana we have created dedicated testnet token pools where you can exchange your testnet Tez for some of the other currently supported tokens.

kUSD:

https://ithacanet.quipuswap.com/swap/tez-KT1Wgp6qSsDN7mCaDk5XDEQU52MezE8B9mr5_0

cTez

https://ithacanet.quipuswap.com/swap/tez-KT1Q4qRd8mKS7eWUgTfJzCN8RC6h9CzzjVJb_0

tzBTC:

https://ithacanet.quipuswap.com/swap/tez-KT1LJ4YjQkDkiPhazyV7PizE1t59K5wNGxLA_0

uUSD:

https://ithacanet.quipuswap.com/swap/tez-KT1HNg4qC89ZSCJJFE4nhGNTYNmeYsNwMkNF_0

uBTC:

https://ithacanet.quipuswap.com/swap/tez-KT1HNg4qC89ZSCJJFE4nhGNTYNmeYsNwMkNF_2

- Mint tokens with Better Call Dev.

BCD service allows you to mint most FA1.2 and FA2 tokens. Consult with the following table and follow the link corresponding to the token you wish to mint. Then scroll down to read the detailed minting guide.

[FA12] kUSD: https://better-call.dev/ithacanet/KT1Wgp6qSsDN7mCaDk5XDEQU52MezE8B9mr5/interact/mint

Decimals: 18

Token ID: 0

[FA12] tzBTC: https://better-call.dev/ithacanet/KT1LJ4YjQkDkiPhazyV7PizE1t59K5wNGxLA/interact/mint

Decimals: 12

Token ID: 0

[FA2] uUSD, uBTC: https://better-call.dev/ithacanet/KT1HNg4qC89ZSCJJFE4nhGNTYNmeYsNwMkNF/interact/mint_asset

Decimals: 12

Token ID: 0 for uUSD and 2 for uBTC

Now let’s do the minting!

The procedure is slightly different for FA1.2 and FA2 tokens.

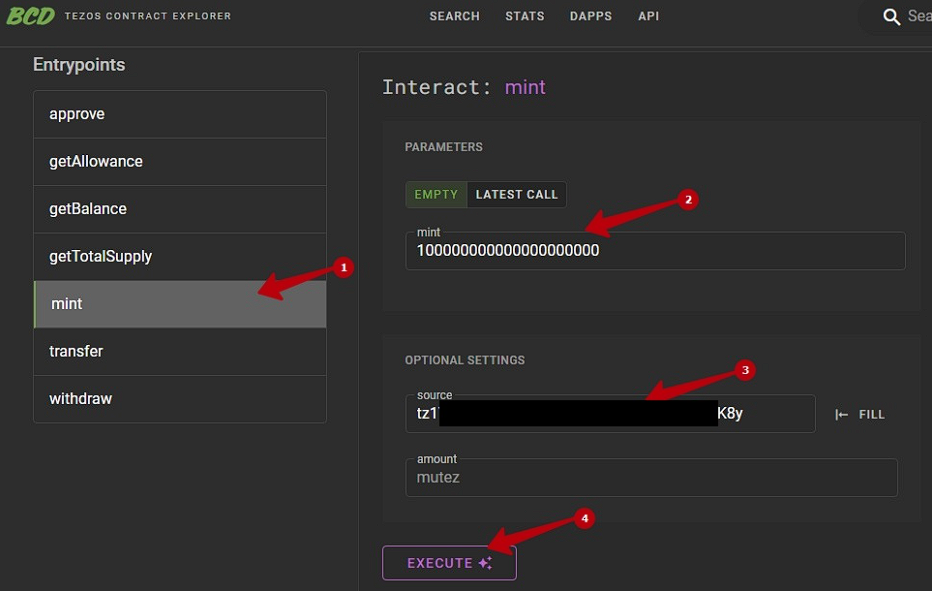

Let’s try minting a FA1.2 token first and take kUSD as an example.

- Once you’re on the BCD page, switch to the mint tab [1].

- Specify the amount of tokens you wish to mint [2].

Note that you need to enter an extra amount of zeros equal to the token’s decimals number.

E.g. kUSD has 18 decimals. So to mint 100 kUSD, I had to add 18 zeros to my initial 100 as shown on the screenshot.

- Enter your test wallet’s address [3].

- Click execute [4].

- Choose the Temple wallet and confirm the operation. Tokens will be in your wallet shortly!

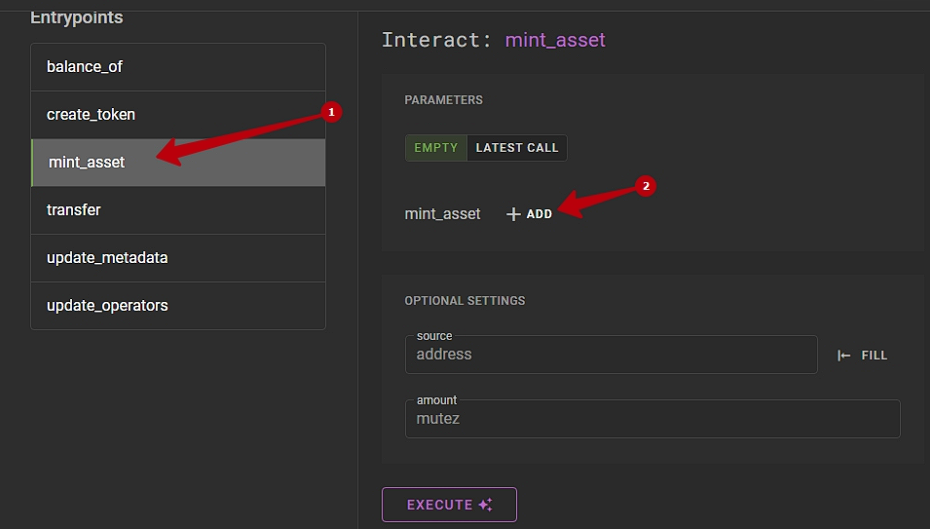

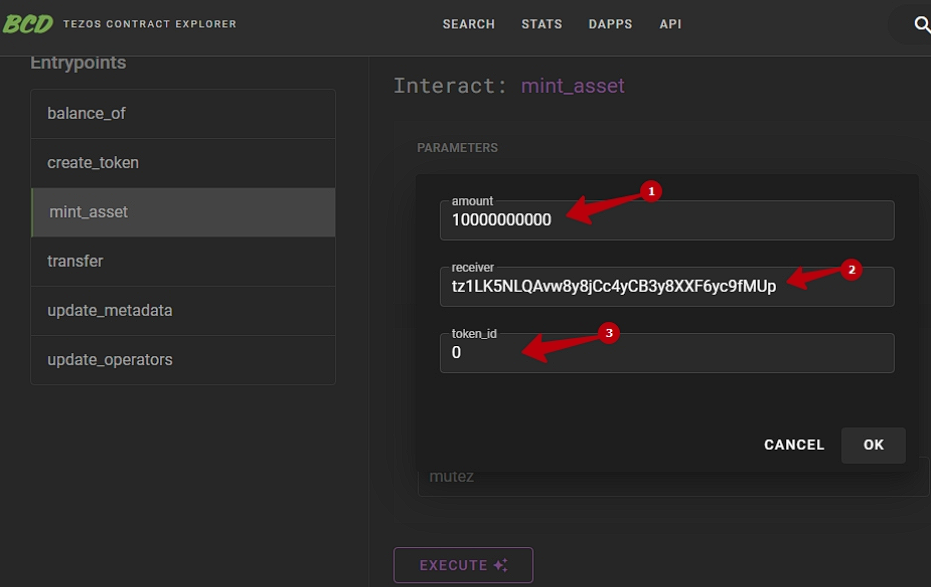

For FA2 the procedure is similar but there are slight differences in the UI.

- Once on the BCD page, switch to the mint_asset tab [1].

- Then click the Add button.

3. Fill in the pop-up fields: the number of tokens to be minted [1] (mind the decimals), your test wallet address [2], and the token’s ID [3].

4. Click Ok, then Execute. Confirm the operation. And it’s done!

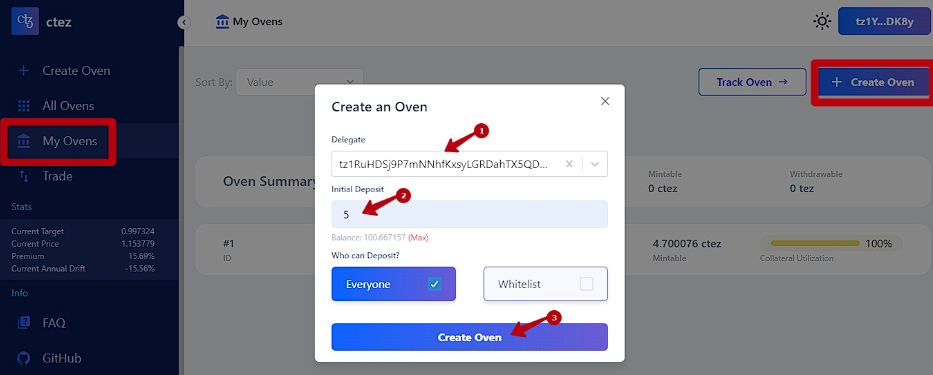

3. How to mint cTez.

Acquiring testnet cTez happens on the dedicated platform: https://ctez-testnet.netlify.app/

- Click My Ovens.

- Click create Oven.

- Pick any baker [1], allocate some testnet Tez [2], and click Create Oven[3].

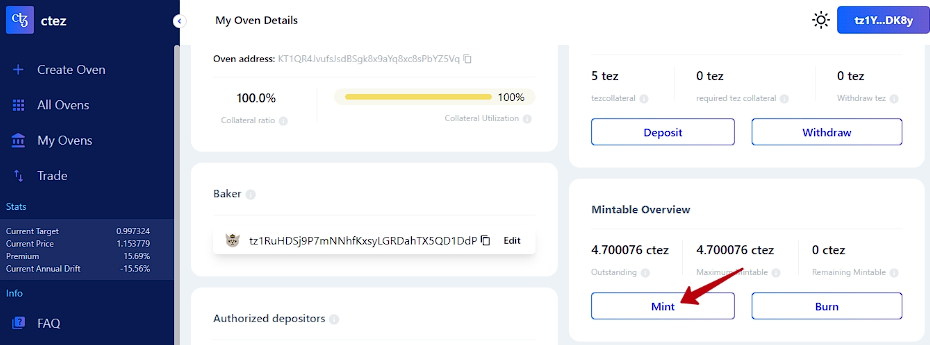

4. Go back to My Ovens and choose the Oven you’ve just created.

5. Click Mint in the bottom right corner and choose how much testent ctez you would like to mint. Click Mint again.

6. Confirm the operation and wait for ctez to appear in your wallet.

4. A word on wTez

wTez is a FA2 token specific to Yupana platform. It is basically wrapped Tezos.

We need it to exist because Yupana only supports FA1.2 and FA2 tokens, thus it can not support the actual Tez.

You do not need to mint or buy wTez. Yupana protocol will automatically wrap your testnet Tez and turn it into wTez as you interact with the platform.

Thank you in advance for your goodwill and help!

Yupana.Finance was developed by the MadFish team, creators of Quipuswap DEX and Temple wallet. Yupana smart contracts have been audited and secured. The protocol is completely open-source, which allows anyone to interact with a user interface client, API, or directly with the smart contracts on the Tezos blockchain.

Follow us on Social media and never miss an update:

Twitter: https://twitter.com/YupanaFinance

Telegram: https://t.me/MadFishCommunity

Discord: https://discord.gg/pcTfP77JV9

Reddit: https://www.reddit.com/r/MadFishCommunity

Facebook: https://www.facebook.com/madfishofficial

LinkedIn: https://www.linkedin.com/company/mad-fish-solutions/

Our blog: https://madfish.solutions/blog