Although Tezos is a mature and, in some sense, popular platform among the DeFi community, we’ve never had a full-fledged and open-source lending protocol before the Yupana.Finance release. This may have led to a situation where some parts of the Tezos DeFi community didn’t have the necessary basic knowledge on how liquidity protocols work.

If you are one of these people or just need to refresh your knowledge, you are in the right place. We decided to create a detailed guide to explain how the different roles within the protocol work and how to get onboarded, earn a profit and use other lending benefits.

Please note: this article doesn’t contain a Yupana review and concentrates on providing guidelines and advice on how to interact with the protocol. A full review of Yupana.Finance is available here.

How does Yupana work?

Using the platform is simple enough. Let us walk you through each activity on the platform.

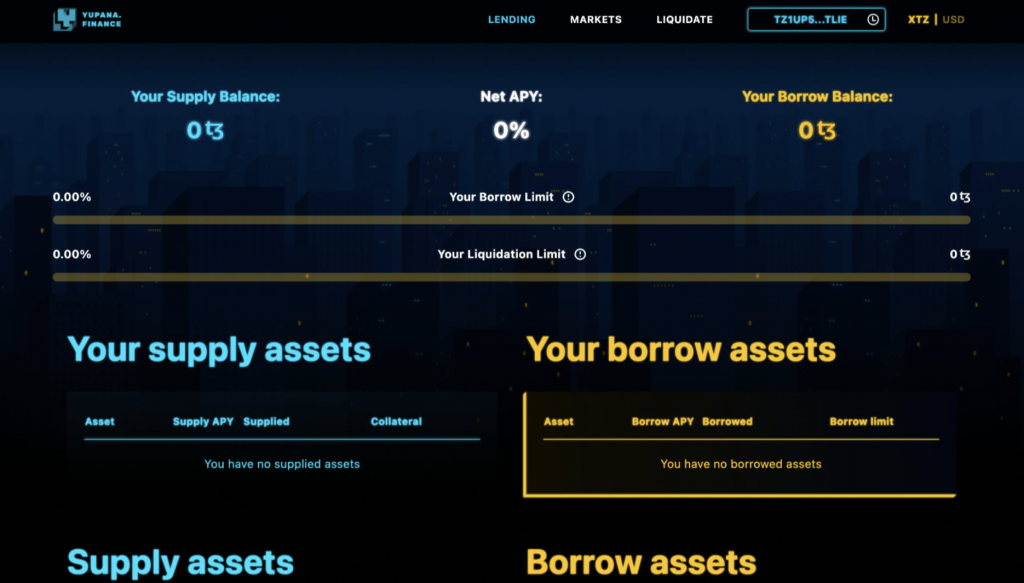

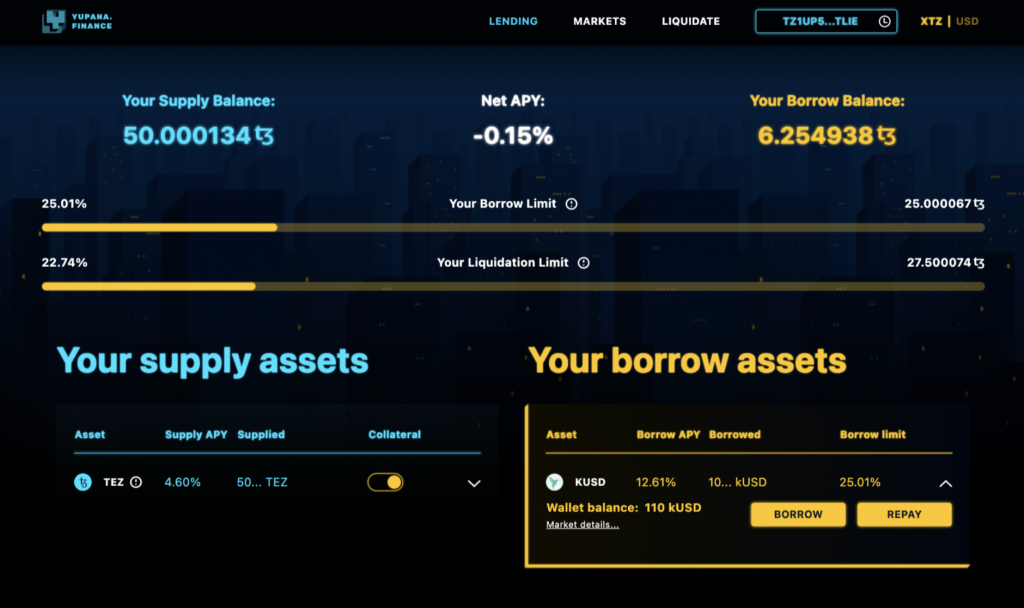

Once you sync your wallet to Yupana, you will see a personal dashboard on the upper part of the screen.

It shows your supply balance (the overall value of your deposits) and your borrow balance (the value of borrowed assets). In addition, your borrow limit (the maximum value of a loan you are eligible for) and liquidation limit (the credit limit after which your debt will be liquidated) are displayed below.

Lending

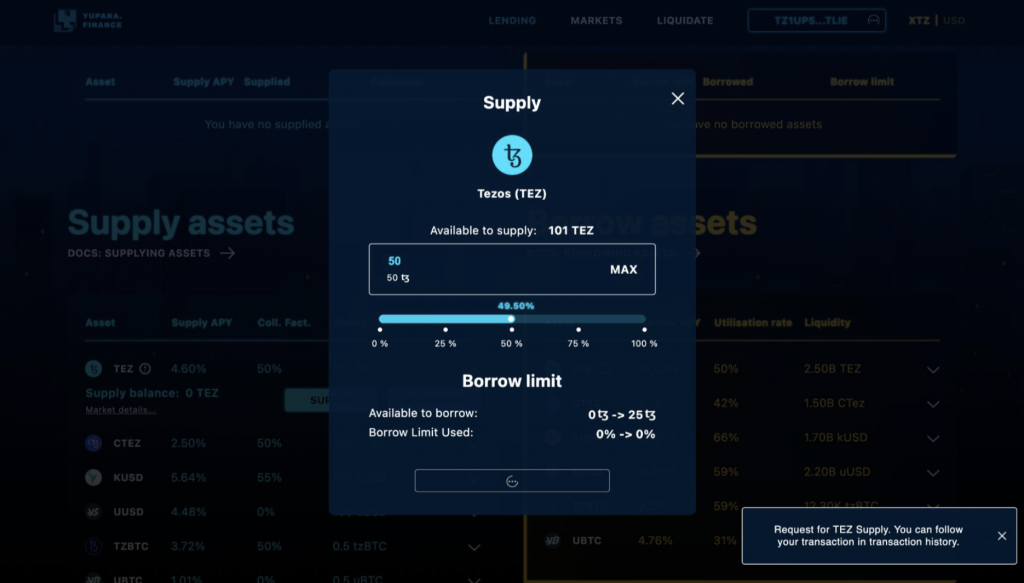

Making a deposit is not dissimilar to locking assets in most other DeFi protocols.

As a lender supplies an asset, a borrower can pick the asset up and start paying the interest on their debt. Some of that interest is funneled into the Yupana reserve fund, but most of it is distributed to the suppliers starting from the first block. The interest paid to the supplier is added to the body of the deposit and can be collected as the deposit is withdrawn.

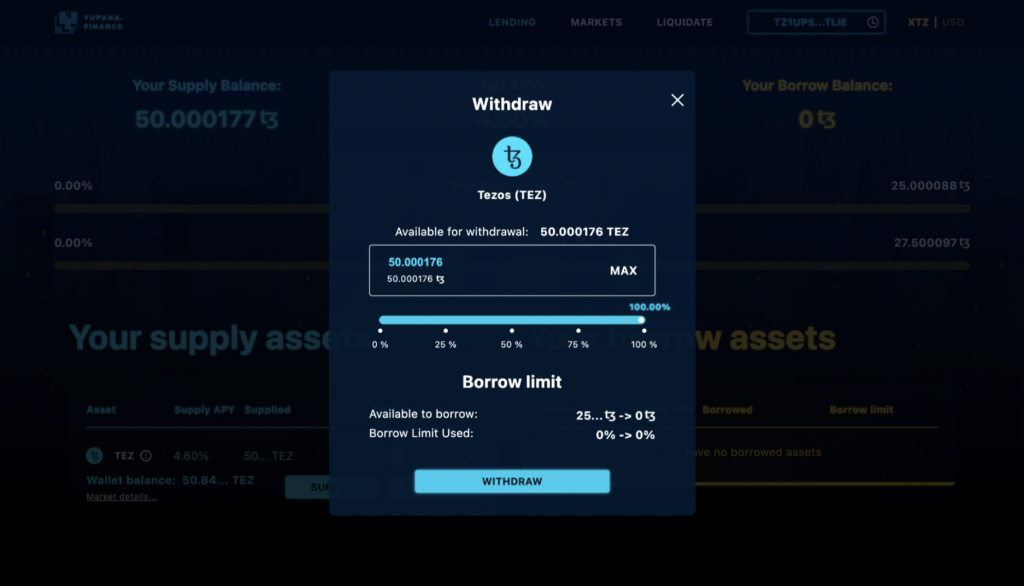

The deposit can be withdrawn at any time unless it is already used as collateral.

The lender’s deposit may also serve as collateral (togglable), allowing them to borrow assets from other protocol users with interest. Thus lenders and borrowers can seamlessly assume both roles.

Borrowing

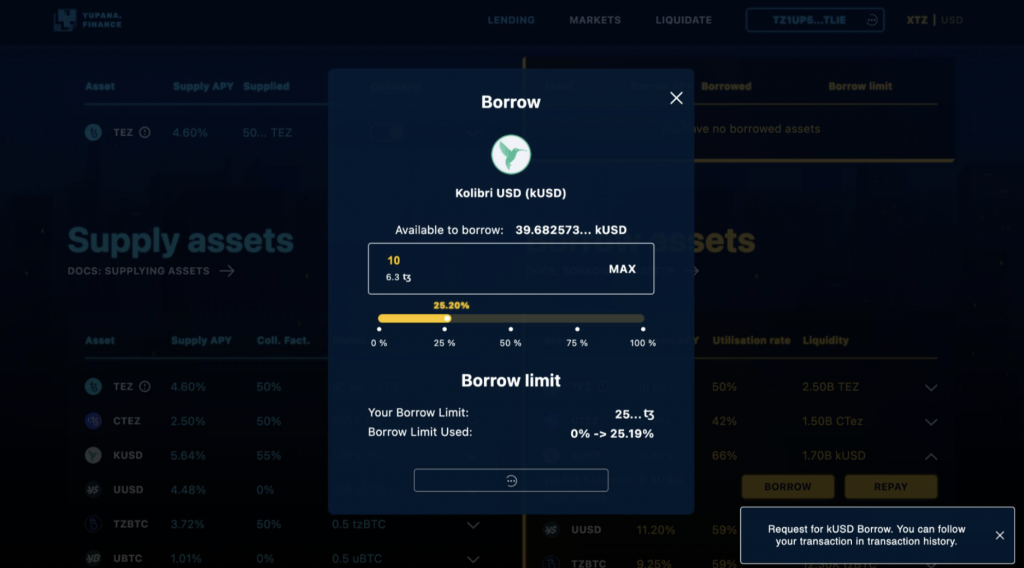

Borrowers can take out a secured loan directly through the Yupana protocol as P2P lending. To get a loan, the borrower needs to supply assets more valuable than the loan amount as collateral. Collateral rates are specific to each asset.

The size of the available loan depends not only on the size of your collateral but also on several other variables, like the current liquidity in the pool and your health factor.

Borrowing happens in the Borrow Assets section, but this is only possible once you have set collateral.

The interest rate on loan depends on the specific asset and is determined by the ratio of supply and demand for that asset. The current interest rates on your active loans can be checked in the Borrowings tab of your dashboard.

Loans have no time limit, but rising percentages and exchange rate volatility may change your supply/debt ratio. As a result, your health factor may deteriorate, leading to eventual liquidation. To avoid your collateral being liquidated, you need to keep an eye on your health factor. To increase it, you can partially repay the loan or allocate more assets as collateral.

The health factor shows the safety of your borrowed assets to the value of your deposit. The higher this value, the safer your credit position. When your health factor goes below 1, your assets are liquidated.

Liquidation

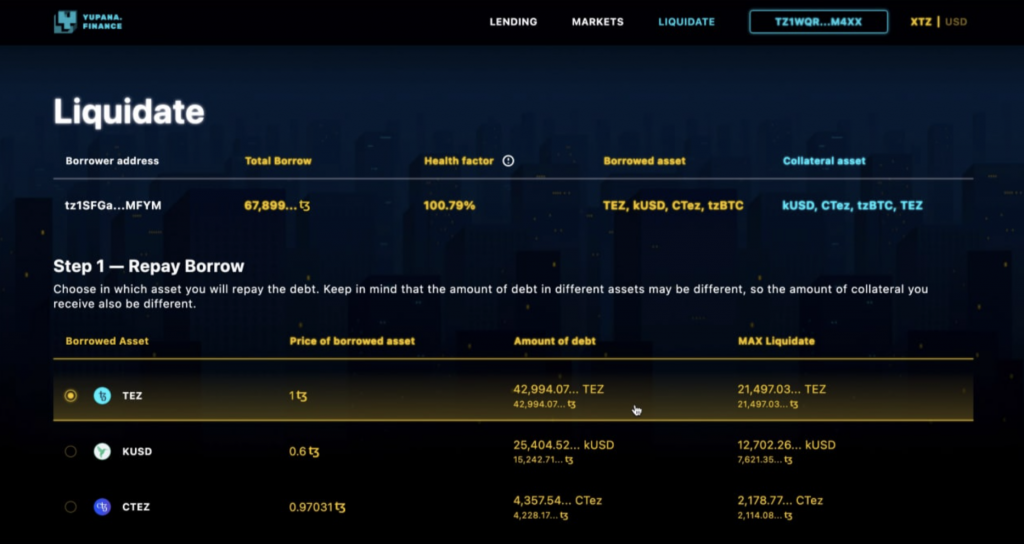

Liquidation happens when the margin between the collateral supply and the debt becomes too narrow, the health factor drops below 1, and the loan can no longer be considered sustainable. At this point, another user may repay a part of the outstanding amount of the borrower’s debt and thus purchase his collateral at a discount.

Users can participate in the liquidation by simply closing positions in the Liquidation tab.

Bear in mind that there may be high competition to close loans, and liquidators will have to develop their solutions to liquidate loans and receive bonuses first.

Hopefully, this article answered your basic questions. More information on the under-the-hood working of the platform can be found here.

If you still have questions or would like to make a suggestion, talk to us via our official channels:

Twitter: https://twitter.com/YupanaFinance

Telegram: https://t.me/MadFishCommunity

Discord: https://discord.gg/qFRZ8kVzkv

Reddit: https://www.reddit.com/r/MadFishCommunity

Facebook: https://www.facebook.com/madfishofficial

LinkedIn: https://www.linkedin.com/company/mad-fish-solutions/