Decentralized lending platforms possess at least 2 advantages for users: you can perform financial operations with no intermediary, and gain profit on the interest earned on the supplied asset. These platforms are the most popular DeFi protocols: according to DeFi Pulse, there are $32.64 billion locked in only 3 major lending protocols (namely, Maker, Aave, and Compound) as of May 2021.

We’ll explain why lending protocols in DeFi attract so much attention and how they innovate the similar mechanisms of traditional financial platforms.

Traditional financial services vs. DeFi

Imagine that you enter a bank with the purpose of obtaining a loan. Are you familiar with the process? You’ll be asked to show your passport, sign several papers, and agree on the terms and conditions offered. But DeFi lets you lend and borrow directly, without having to involve a third party and reveal your identity. Since all the balance verifications and transactions happen in smart contracts, nobody will ask for your personal data for keeping or giving you money.

Despite promising stability and reliability of their services, traditional banks pose serious risks to lenders. When you deposit money into a bank, it uses your funds for its own purposes. As past financial crises in the banking sector have shown, such activity can become the reason for bankruptcy and severe money loss. In the traditional financial world, people try to avoid these risks by referring to alternative lending marketplaces. However, even if you enter a lending company, there’s no guarantee you’ll get a loan without having to provide personal information and/or show reliable credit history. In any case, all the operations require you to rely on a third party and reveal your identity.

Main problems associated with banks

Risk of bankruptcy and general mistrust of the system

- Strict regulations and specific criteria you should follow

- Need to verify your identity to employ their services

- Need to explain where you get your money from

- Instruments of control (investigations, blocking accounts, etc.)

- Putting personal data at risk of theft

DeFi works under completely different rules. The space is fully anonymous, so it grants access to the wider public to lend and borrow. You can participate in these financial operations from any location, notwithstanding your credit score and without the need to reveal your income source. All the assets are locked in smart contracts. You use them as collateral (the borrower’s deposit in the protocol) to start borrowing. Alternatively, you can earn interest on the deposit.

In contrast to traditional financial services, DeFi protocols have no intermediary. Smart contracts make borrowing and lending easy, fast, and fully anonymous.

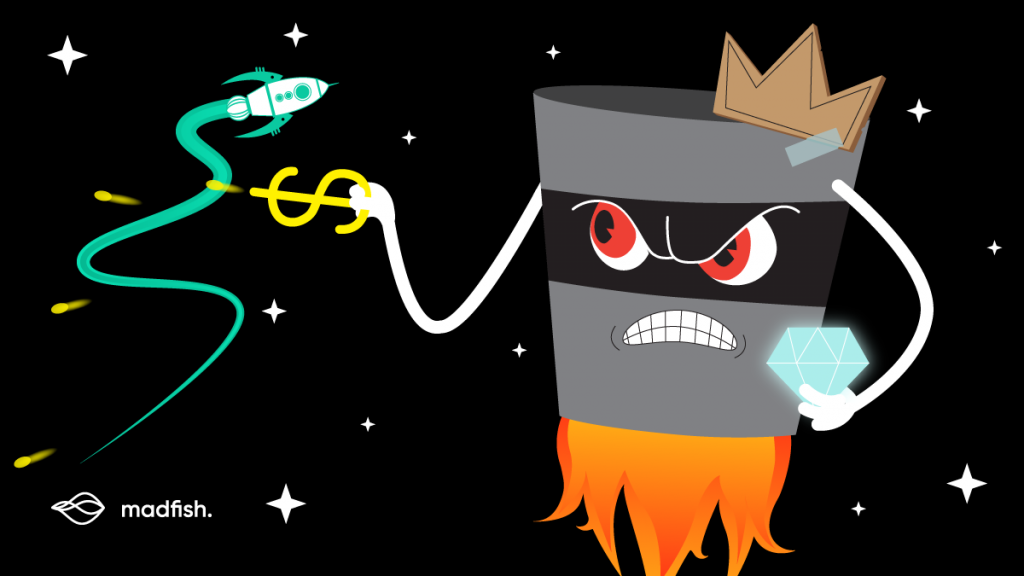

Key advantages of lending protocols in DeFi

- Total control over your funds: You can access your assets at any time and do whatever you want with them without having to ask for permission. You also avoid the risks related to the transfer of funds to a custodian.

- Transparent and borderless system: Anyone can start interacting with a lending protocol; there’s no need to show your passport as there is no central authority. You can be anywhere in the world to start lending and borrowing.

- Automation of processes: All the transactions are processed in smart contracts. The code prescribes all the terms and conditions for lending and borrowing.

- Profitable asset allocation: You can increase the profitability of your portfolio by generating income from borrowed and deposited assets.

Lending protocols in DeFi have risks. In particular, you should check the safety of smart contracts. Another problem is the volatility of the APR (Annual Percentage Rate). Since this indicator depends on the ratio between loaned and borrowed funds, it can change really fast. The safety problem is a common concern in DeFi, that’s why it’s highly recommended to keep an eye on your private keys and the projects you’re participating in. Conduct extensive research on audits made and track APR dynamics before entering the lending protocol.

The 3 most popular use cases of lending protocols

1. Payday loan: Suppose you have cryptocurrency that you don’t want to sell too early (because you believe its price will go up in the future), but you need money now. In this case, you can deposit this asset on the lending protocol, get a loan in the form of stablecoins, and sell the stablecoins for cash. On the appointed day, you pay back the loan and unlock your deposit.

2. Short-term trading: If you predict that the price of a cryptocurrency you own will rise, you can deposit it in exchange for stablecoins and use these to buy even more of this cryptocurrency. When the price increase happens, you can repay your loan and still profit from the price increase.

3. Deposit: On the lending protocol, you can supply your tokens without taking out a loan and, in return, earn interest much higher than that offered by banks.

You can use lending protocols in DeFi for purposes other than these three. It all depends on your investment strategy and aims.

How DeFi protocols work under the hood

Traditional banks ask for your identity and use your loan for their own benefit. You’ll never know the details and you won’t be able to track the possible problems.As for lending protocols, they take your crypto as collateral and lock it in the smart contract. The process remains anonymous and transparent: you can access your assets anytime.

Basic Principles

Since the set of smart contracts creates pools of locked funds, protocols make a market of loanable funds where you can interact with multiple borrowers and lenders directly. There is no dependence on profitability or directives from any central authority. On the lending platform, you interact with the set of smart contracts instead.

In DeFi protocols, the interest rates depend on the dynamic between the supply and demand for the funds. Again, there is no central bank to announce and change the rates. The rules are set programmatically:

1. Since there are more lenders than borrowers on the lending protocol, the interest rate for borrowing is higher than for lending.

2. The amount of assets available for borrowing depends on the quality of the supplied token as collateral and the total fund pool available.

3. The difference between supply and demand determines the liquidity for loanable funds: the higher it is, the lower the borrowing rates.

4. Lenders receive payments in the form of interest paid by borrowers.

5. The data on prices and APY is updated automatically with the changes in supply-demand dynamics.

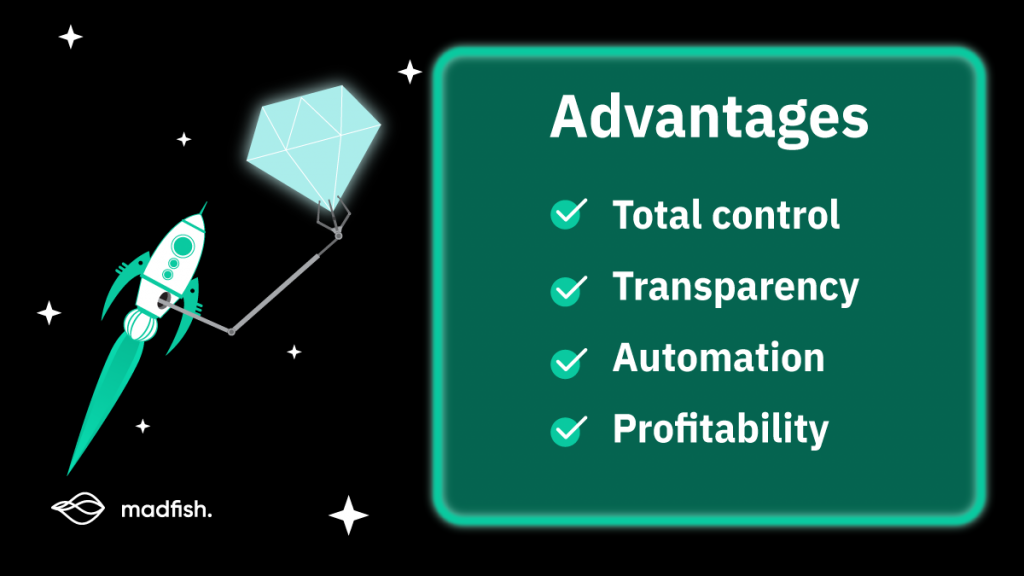

Liquidation

It may happen that the crypto token you’ve placed as collateral loses its value. Another example is when the borrowed asset increases dramatically in value. In both cases, the lending protocol will start the process of liquidation for the same reason: the collateral vs. the loan value dramatically changes, and your collateral doesn’t cover your loan anymore.

To cover the process, the liquidator appears. This actor will repay up to 50% of a borrower’s debt and claim the liquidation fee (the amount of which depends on the specific asset).

System participants

You can interact with the lending protocol as either a lender or a borrower. You can become a liquidator as well, but it’s usually a highly competitive space. The motivation for each participant is different: the lender receives interest, the borrower receives extra crypto, and the liquidator gets the liquidation bonus when the liquidation process takes place.

Protection mechanisms

In the lending protocol, you deal with overcollateralized loans. This way, the system mitigates the lender’s risks and validates the borrower’s creditworthiness under circumstances where nobody reveals their identity or has any credit score. The percentage of overcollaterization differs from platform to platform.

However, the volatility of the crypto market still results in a high risk of possible liquidation. To protect yourself from this, it’s recommended to deposit more than you borrow (in addition to the overcollateralization requested by the platform).

Alternatively, you can partially repay the loan. This way, the price volatility won’t affect your loan that much.

Takeaway notes

Lending protocols in DeFi establish a transparent system that satisfies the needs of all the platform’s participants. As a borrower, you can gain access to more funds, increase your income, and pay back the loan at a later date using the profits generated. As a lender, you get the opportunity to withdraw your funds at any time, without having to ask for permission, and earn interest on deposits.

But remember: to get all the advantages of the lending protocols in DeFi, you should possess financial knowledge and adopt a smart investment approach.