youves is a decentralized, self-governing, non-custodial platform for issuing synthetic assets on the Tezos blockchain. youves is one of the main providers of stablecoins to the Tezos DeFi ecosystem.

Today we will look at the features and use cases of this platform, but first, let’s take a look at synthetic assets.

Synthetic assets are financial derivatives that don’t give us the right to deliver or own the underlying asset but allow us to take advantage of its price.

What are the differences between synthetic and wrapped assets?

Wrapped assets are backed by those underlying them, which are stored on other blockchains. For example, to issue tzETH on Tezos, you need to lock ETH on the Ethereum blockchain. In turn, synthetic assets can be collateralized by any coin as long as the cost of the collateral is higher than the cost of the issued tokens by an acceptable proportion. A detailed overview of synthetic assets is available on our blog.

In addition to issuing synthetic dollars and cryptocurrencies from other blockchains, youves offers other opportunities that will be discussed in this article.

Minting Synthetics (Borrowing)

For example, a user can lock collateral in TEZ to mint uUSD synthetic assets. It works like a loan — a user locks TEZ and, in return, receives a uUSD amount equivalent up to 33% of the locked collateral.

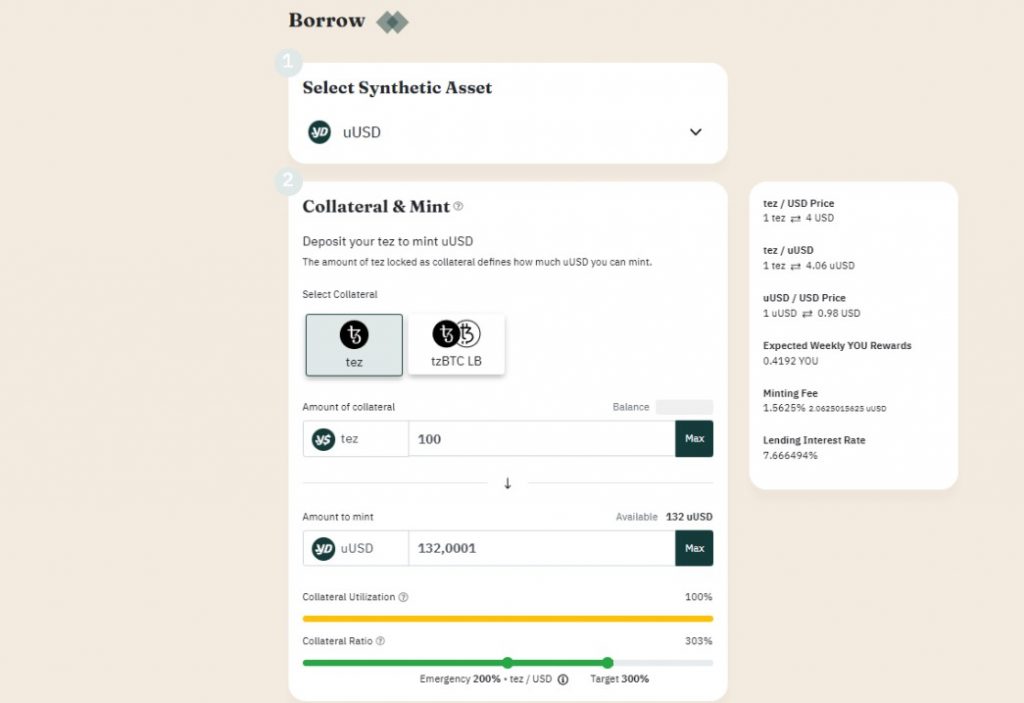

To create synthetic collateral with youves, go to the “Minting” section and connect your Tezos wallet to the protocol. You must then choose which asset (TEZ or tzBTC LB) you will use as collateral.

Enter your chosen collateral amount and choose how many synthetic assets you want to mint. Pay attention to the Collateral Utilization and Collateral Ratio parameters. The maximum collateral factor is 300%, which means that for each $1 of TEZ you collateralize, you get up to 33 cents in uUSD

You can issue fewer tokens than the maximum collateral ratio allows to protect your credit position as much as possible from the high volatility of the collateral asset.

The minting fee is 1.5625%, which forms the income of the platform.

If the vault’s owner allows the collateral factor to drop below 200%, other users can increase it on his or their behalf. In return, they are entitled to a reward of 12.5% of the amount of redeemed stablecoins in TEZ. The platform will take the reward from the vault owner’s deposit.

Your TEZ will remain in your possession and will be unlocked upon exiting the position if the protocol rules are followed correctly and the collateral covers the minted coins. Therefore, before minting, you must first select the baker who will pay you the baking fee. Click “Mint Now” and confirm the transaction in your wallet.

The minting process rewards the minter with YOU tokens, the platform’s governance token. YOU tokens will be credited to your wallet along with minted synthetic tokens.

Synthetic assets available for minting are uBTC, uDEFI, uUSD, and uXAU:

- uUSD — an algorithmic Stable Token pegged to the fiat USD. It is fungible by design and backed by TEZ collateral.

- uDEFI — a price index tracking the performance of the tokens of successful DeFi projects such as AAVE, CAKE, LINK, LUNA, and UNI.

- uBTC — an algorithmic Stable Token pegged to the value of uBTC and collateralized in TEZ.

Staking

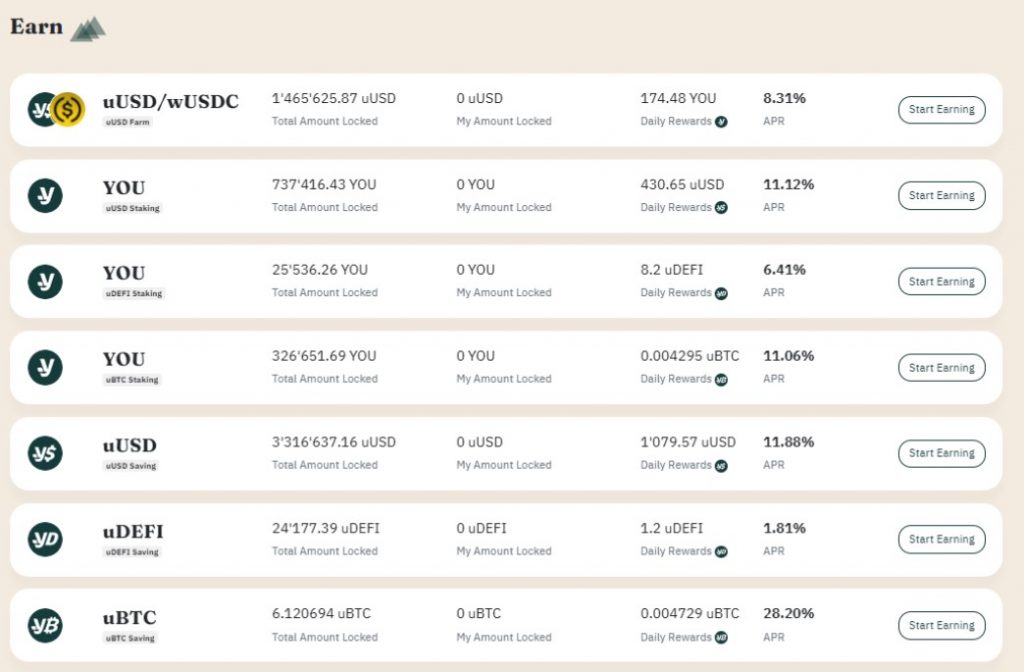

The platform offers the staking of assets such as the YOU governance token, issued synthetic assets, or even LP tokens of the uUSD/wUSDC pool. Stakers are rewarded in tokens with APRs ranging from 1.8% to 30%, depending on the mining program.

To start earning a passive income on youves, go to the Earn section and connect yourTezos wallet to the protocol.

Select a mining program and click “Start Earning” to stake tokens and earn rewards.

The youves DEX (CFMM)

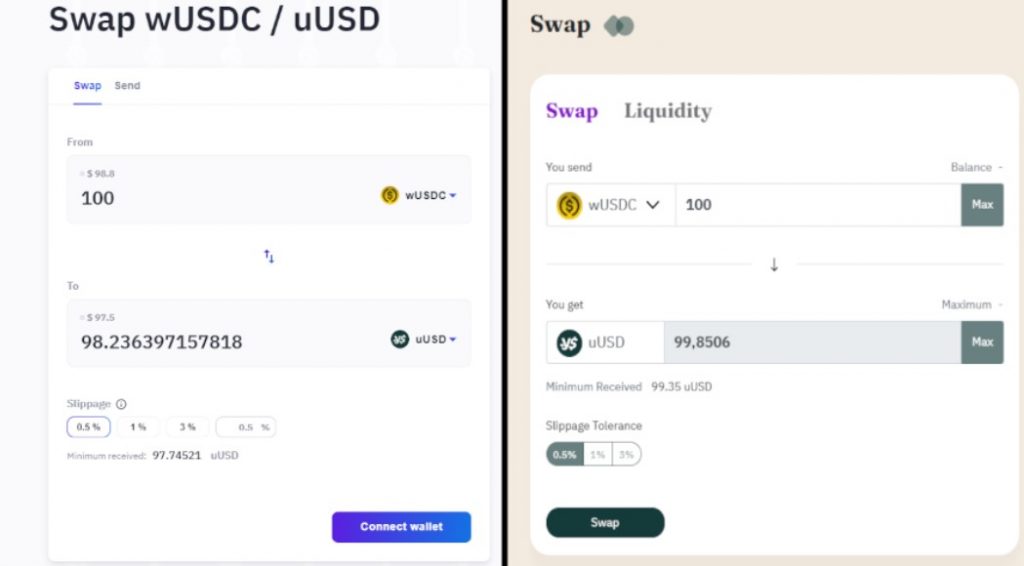

The youves platform also includes a swap feature with a constant function market maker (CFMM). The CFMM model is optimized to have a flat response curve. The goal is to limit the slippage for 1:1 pairs, such as wUSDC/uUSD or tzBTC/uBTC.

“The fees on each pair will be applied to the gross input on the swap, leaving the net input. The output of the swap is calculated using the Newton-Raphson method applied to the CFMM curve and the net input” — this is how the model description looks like, the explanations and graphics of which are considered the github repository.

Put simply, it means that this flat curve function is suitable for asset pairs that are highly correlated. For example, let’s compare the difference in the wUSDC/uUSD exchange on QuipuSwap and youves:

With an increase in the transaction amount, the difference in the amount of tokens received increases further. Thus, youves CFMM offers a really profitable “1:1 pairs” exchange model.

Any user can provide liquidity to any available pool and receive rewards from mining programs as well as trade commissions.

Oracle

The protocol uses a price oracle to obtain stock prices for its smart contracts and to replicate the price movements of the underlying assets.

To work with off-chain data, youves uses the oracle service from ubinetic but with multi-channel support. ubinetic transmits information with the help of third parties, and large crypto exchanges are used as sources. This Oracle is technically protected from data modification through the exchange API.

youves Governance

The governance model is built on a multisig process but it is planned to change this to a true DAO model in which the YOU token holders community makes the decisions.

The process of updating and managing the platform is controlled by T̶h̶e̶ ̶F̶e̶l̶l̶o̶w̶s̶h̶i̶p̶ ̶o̶f̶ ̶t̶h̶e̶ ̶R̶i̶n̶g̶ Key holders, which consists of two members of the developer team and five external parties independent of the developer. Together, key owners can make decisions and sign transactions given that 4 out of the 7 parties consent.

youves Keyholders: Agile Venture, Baking Bad, ECAD Labs, Kukai AB, madfish.solutions, Papers AG, ubinetic AG.

In the future, select youves governance matters which require frequent decisions will be moved to a voting system that is open to everyone that holds YOU governance tokens. Governance votes may take place in a six-month interval.

Wrapping-Up

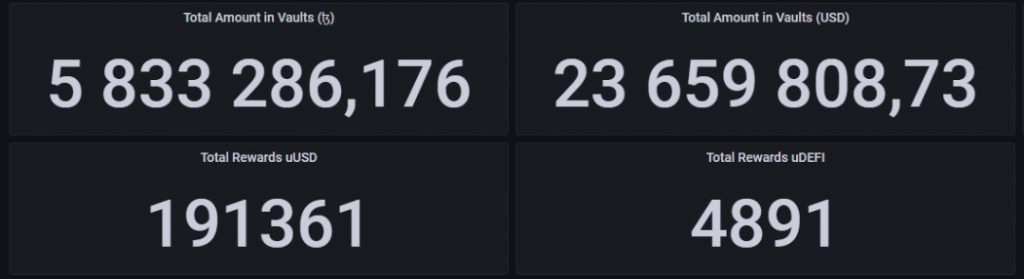

As of February 2022, almost 5.8 million TEZ tokens (approximately $24 million) are locked in youves vaults, and synthetic tokens issued by the protocol (as well as the governance YOU token) are traded on all popular Tezos DEXs.

Since its development, the project has become an integral part of the Tezos ecosystem, becoming one of the first providers of tools for working with synthetic assets and collateral lending for Tezos users.

To follow the development of the project and see other youves updates, subscribe to their Medium and join the discussions in their Discord and Telegram communities.

Follow the Madfish team to go on a further journey through the Tezos ecosystem: Discord | Telegram.