In the previous blog post, we’ve сlarified how lending protocols improve getting loans and making deposits in the DeFi ecosystem. Now it’s time to apply this knowledge in practice! We’ve selected and described 5 most reliable platforms for you to start using lending protocols.

How to start using lending protocols

DeFi, or decentralized finance, is the space where numerous dApps, or decentralized applications, function. It’s like an open-air music festival with several stages where bands play different music: when you wander around DeFi, you can encounter trading platforms, yield farms, synthetic assets, derivatives, and many other types to enter and participate in.

A lending protocol is the dApp that lets crypto holders lend and borrow tokens in DeFi. For example, you can use these platforms to make deposits, get payday loans, participate in short-term trading, or achieve your other investment aims.

Here’s the simplified version of the typical steps needed to start using lending protocols:

1. Visit the website of the lending protocol platform chosen in your browser.

2. Connect your crypto wallet and make sure you’ve picked the Mainnet network.

3. Pick the tokens you want to deposit and select the amount you’re ready to supply. But consider the gas fee amount that is not included — or simply press MAX to check the maximum amount you can supply.

4. If you want to borrow, select the tokens you want to take on the corresponding tab. Again, the platform will limit their amount — depending on the platform rules on overcollateralized loans.

5. Cover the debt to unlock the tokens supplied as a loan — or withdraw the deposit anytime if you haven’t borrowed anything.

This basic principle may change from platform to platform. Also, some additional factors can intervene and break the scenario — for example, the price volatility that will devalue your deposit and cause liquidation. We’ll uncover these risks in more detail at the end of this article.

Top 5 platforms to start from

We recommend trying the functionality of lending protocol from the platforms with the most liquidity locked. Based on the information presented on the DefiPulse website, the most popular platforms by May 27, 2021 are

1. Maker: $9.86 billion USD locked

2. AAVE: $9.15 billion USD locked

3. Compound: $8.06 billion USD locked

4. InstaDApp: $5.09 billion USD locked

5. Liquity: $2.31 billion USD locked

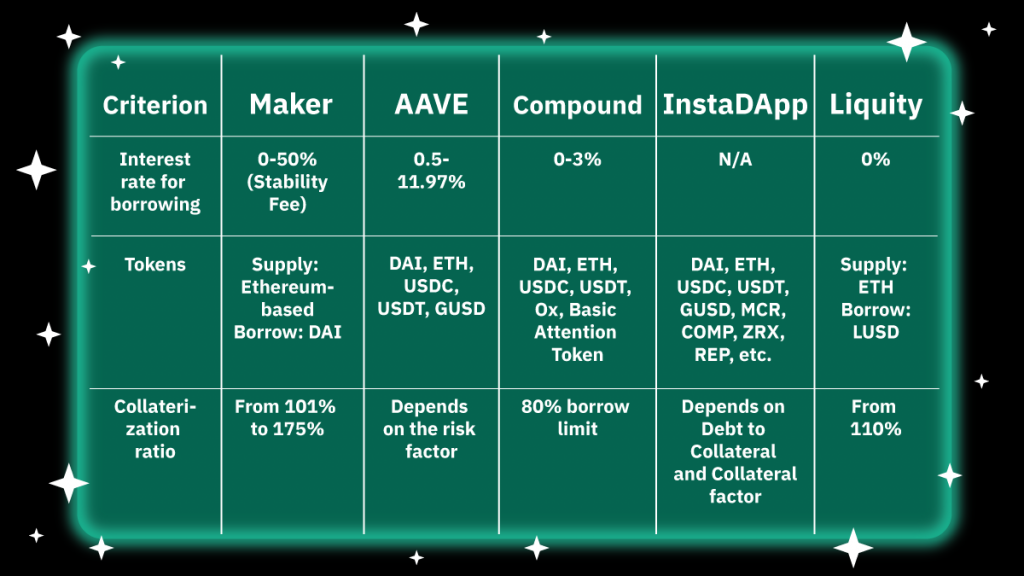

The table below provides a short comparison between these 5 platforms. Find more details about each in the descriptions below.

All the data in the table are used for illustrative purposes only and are relevant for May 26, 2021. This information may change anytime. Please check the numbers by yourself before making a decision!

#1 Maker

The Maker Protocol, also known as MakerDAO and Multi-Collateral DAI system, is the platform that allows generating DAI, a stable cryptocurrency linked to USD to make it resistant to volatility. The extra effort on maintaining DAI stability is provided by MKR holders, the users who have the governance token of the platform.

On the Maker, you can deposit your Ethereum-based assets in Maker Vault and generate DAI to borrow. While repaying the debt, you will pay a Stability Fee. Liquidation starts if the collateral and the borrowed amounts don’t meet the requirements of the Liquidation Ratio set by the MKR voters. If the price information for the collateral is unavailable, the asset can still be sold on the internal Collateral Auction.

Since Maker depends on the third-party providers to operate in some parts of Latin America, it established some limits for the maximum and minimum DAI amount you can buy. Check the details here.

#2 AAVE

AAVE is a decentralized liquidity market protocol where you can lend and borrow tokens. The platform is known for its high cost and numerous fees. For example, it always takes 0.00001% from borrowers (to distribute 20% to referral integrators and 80% to the protocol fund) and 0.09% from flash loans.

In AAVE, you can withdraw the deposit anytime and export it in a tokenized version (aTokens). The protocol differentiates the stable rate, which is more predictable, and the variable rate that depends on market decisions. In fact, this provides more options for your investment strategy. All the common risks connected with using smart contracts and possible liquidation remain, though.

#3 Compound

Compound is the protocol that makes money markets. They determine the interest rates automatically, by reacting to the supply and demand of each token. This way, the protocol creates liquidity pools for supplied assets, letting users borrow not directly from a single lender but from the pool on the platform.

As for the remarkable trait of Compound, it’s representing all the users’ supply in cTokens which become convertible once the interest from borrowing is collected. You can trade these tokens, but remember — they are linked to your Compound balance and can decrease it.

#4 InstaDApp

InstaDApp is the DeFi management platform where you can build your DeFi portfolio. It aggregates several lending protocols in one place, including the above-mentioned MakerDAO, Aave, and Compound.

In InstaDApp, you can deposit assets in three ways: through QR code, by selecting the token manually, and by migrating your position from MakerDAO, Aave, or Compound. As for the liquidation of the borrowed assets, it starts once you reach the maximum Debt to Collateral ratio. To see the exact calculation, check its explanation here.

You can try InstaDApp in the simulation mode with 100 ETH delivered to your account for the test.

#5 Liquity

This platform allows you to deposit ETH and borrow LUSD tokens without paying interest and with minimum overcollateralization. For that to happen, the platform charges one-time borrowing and redemption fees to encourage using the protocol more than once.

In detail, deposit and loan are kept in a single Trove, linked to your Ethereum address. Each address can possess only one Trove. The minimum debt required is 2,000 LUSD. You can repay it anytime as the overcollateralization remains at least 110%.

How to protect yourself from risks while using lending protocols in DeFi

Using any lending protocol requires an understanding of possible profits and risks. Here are some dangers and our recommendations on how to protect your investment on the platforms:

- Hacks of smart contracts. It’s hard to provide a 100% guarantee of safety in DeFi. The presence of a security audit on the lending protocol should increase your confidence.

- Liquidation. The ratio between your supply and borrow may fall critically, and you can lose your money. To prevent that from happening, constantly check the change in numbers and be ready to react accordingly.

- Price volatility. The cryptomarket changes really fast, and the only way to protect your deposit is to put more than you borrow. That’s why we don’t recommend puting all your money and borrowing the maximum instead.

Start using lending protocols as one of the tools in your investment strategy, and never risk it all!