Hello! You might be familiar with our team from the first article, where our guys were creating a Solidity to Ligo transpiler.

It all started at the hackathon too 🙂

In 2019 Tezos Ukraine organized a hackathon in Kyiv to develop projects for the Tezos ecosystem. Some of our guys decided to create a transpiler, (and yes it was a great idea, which took first place!). Some of the guys wanted to build a cryptocurrency wallet, but we being true believers in decentralized finance and smart contracts decided to make a protocol for an automated token exchange on Tezos.

We were not as successful at Hackaton as our colleagues with Thanos wallet on 3rd place or Sol2Ligo transpiler on 1st place, but Tezos Foundation appreciated our efforts and we received a grant.

What is it?

Exchange Contract Designed For Liquidity

QuipuSwap is an open-source protocol that provides an interface for the seamless exchange of Tezos-based Tokens and XTZ. The best part is there are no intermediaries, the priority is in decentralization and censorship resistance.

Lack of counterparty

Both on centralized and decentralized exchanges, the transaction requires the participation of the buyer on the one side and the seller on the other. In our approach, there is no need for counterparty for the transaction to happen.

Constant liquidity

On ordinary exchanges, the liquidity of a token directly depends on the presence of sellers and buyers. In our contract tokens are going to be always available for purchase regardless of trade volume due to automated price calculation and liquidity providers.

Lack of the order book, predictable slippage

On the usual trade platform, you need an order book where you can connect counterparties. Orderbook is usually very dynamic, so it’s hard to predict the price. If you need more than one counterparty, this is where the task becomes very complicated 🙂

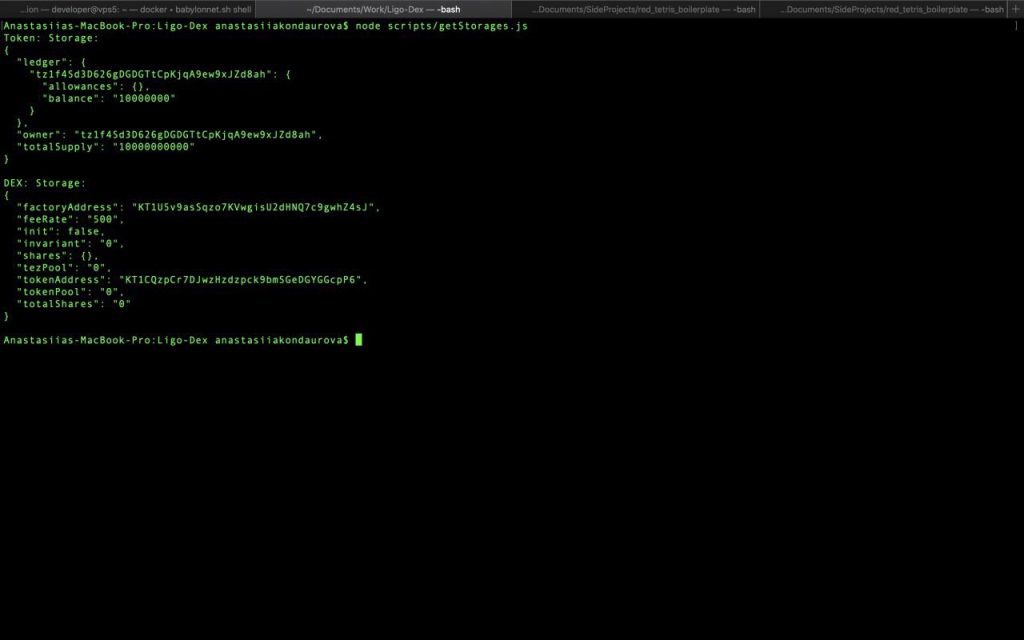

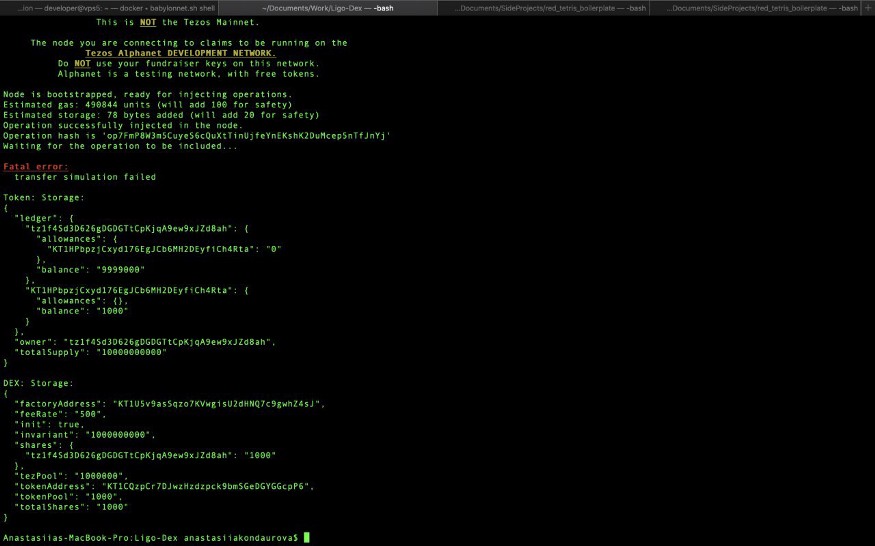

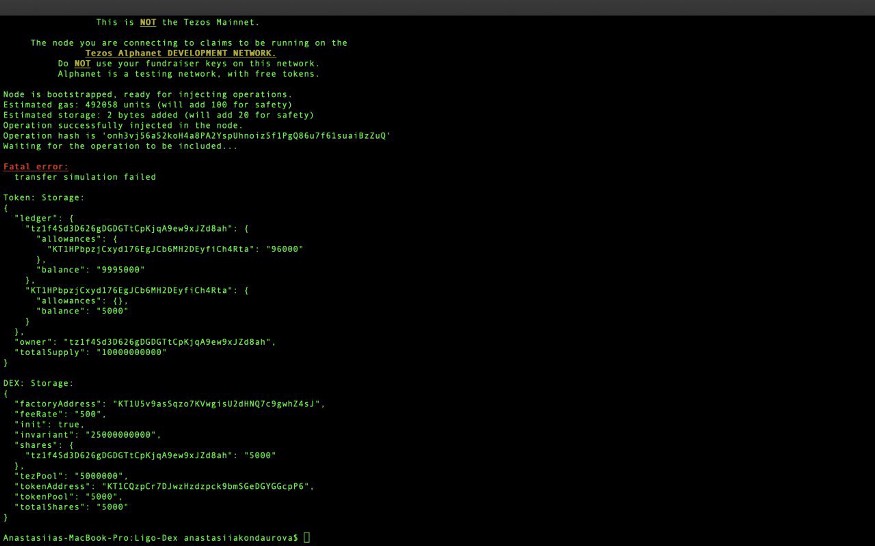

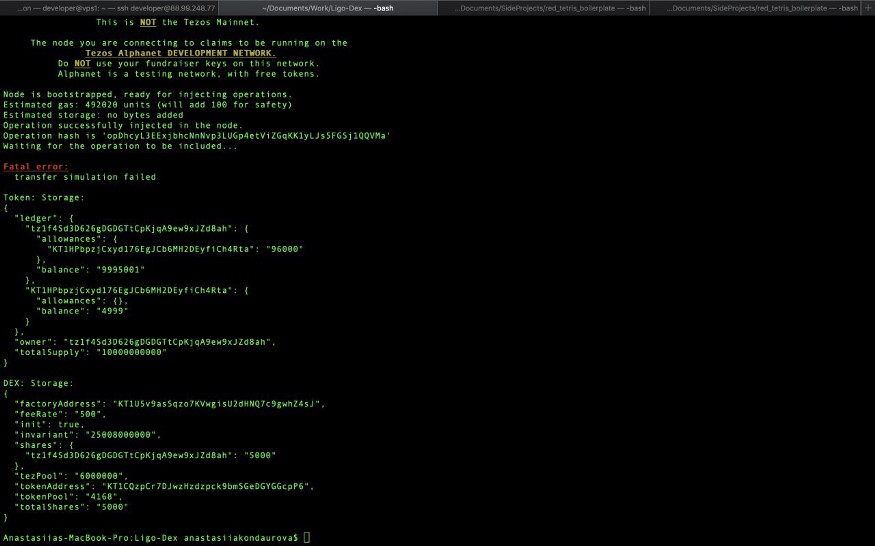

What do we have now?

- Initialization of DEX;

- Liquidity investment;

- Liquidity returning;

- Tezos (XTZ) to Token Exchange;

- Token to Tezos (XTZ) Exchange;

- Token to Token exchange;

All functionality can be tested with scripts in scripts/ folder.

What are our goals?

- Create an easy-to-use UI for users to interact with the system (Exchange and Providing Liquidity)

- Incentivize liquidity providers by adding a fee that they will earn proportionally to their deposited liquidity share

- Support all Tezos token standards (Multi-Asset Contract, FA1.2, etc.) to cover as many use-cases as possible

- Allow users to exchange tokens and send them directly to another address from the UI

In the next update, we will describe how it works. See you soon 🙂

Check it out

QuipuSwap — main repo with all the code

Our Facebook and Twitter

https://tezos.org.ua/ — Tezos Ukraine community website

https://twitter.com/UkraineTezos — Tezos Ukraine twitter