Despite the marketing fluctuations and reduced community activity, we are strong believers in DeFi and sure that decentralized solutions will replace many traditional services. Since the QuipuSwap launch in 2021, our team has been conducting a lot of work to make our DEX the most convenient on Tezos. We have launched traditional AMM protocol, curve-like liquidity pools, yield farming programs, QUIPU staking that allows holders to get a part of protocol earnings, and many other important features. Our next significant milestone is to launch the QuipuSwap v3 version.

What is QuipuSwap v3?

Quipuswap v3 is a new type of decentralized AMM protocol on Tezos that significantly increases the efficiency of capital usage and allows liquidity providers to earn more on the same amount of liquidity. Moreover, QupiuSwap users will get more tools to build versatile investment strategies and conduct trades with more favorable rates. The most similar analogy to Quipuswap v3 from another blockchain is Uniswap v3 on Ethereum. In this article, we let the cat out of the bag, share some info about upcoming QuipuSwap v3 features, and start with Concentrated and Active liquidity features.

Concentrated Liquidity

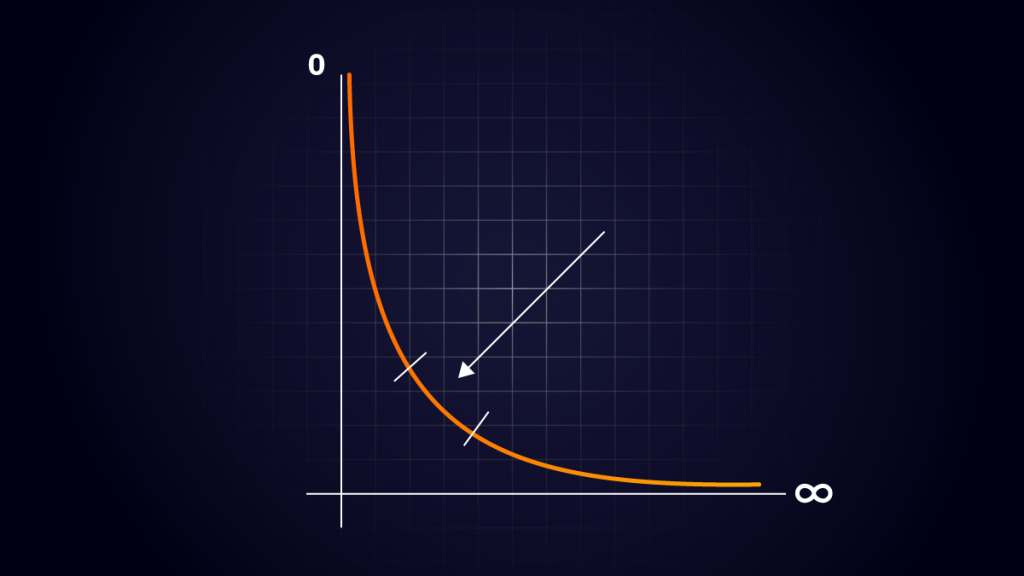

In traditional AMM protocols, liquidity providers just add liquidity to the pool without the possibility of choosing when their tokens should be used. So, this liquidity will be used to handle trading operations with token price ranges between 0 and ∞. However, most trades are conducted when tokens have a specific price range. For instance, 95% of swaps in the kUSD/uUSD pool are conducted when tokens have a price diapason $0.95-$1.05. If we had a possibility to provide liquidity only for this token price range, we could earn 95% of all trading fees and at the same time not freeze our liquidity for other 5% trades. Our capital will be used more effectively, and we will profit more from fees.

QuipuSwap v3 allows liquidity providers to do this. By adding tokens to the pool, liquidity providers create individualized price curves for their liquidity and earn trading fees that are directly proportional to their pool share in a given range.

This feature significantly increases the efficiency from provided liquidity and can be better illustrated by the following example:

Alice and Bob decided to add liquidity to the TEZ/USDT pool on QuipuSwap V3. They each have $1000 and the TEZ price is $1.

Alice created a liquidity pair TEZ/USD and set up its usage across the entire price range (traditional AMM). She deposited $500 and $500 in TEZ.

Bob decided to concentrate his liquidity and provide capital with the TEZ price range between $0.8-$1.3. He deposited 100 TEZ and 100 USDT – total $200 and stored $800 for other purposes.

While TEZ price will be between $0.8-$1.3, Bob earns the same amount of fees as Alice; however, he provided only 20% of Aliece’s capital. As we see, Bob’s capital is five times more efficient than Alice’s. On top of that, Bob risks a smaller sum in comparison to Alice in case of unexpected marketing events.

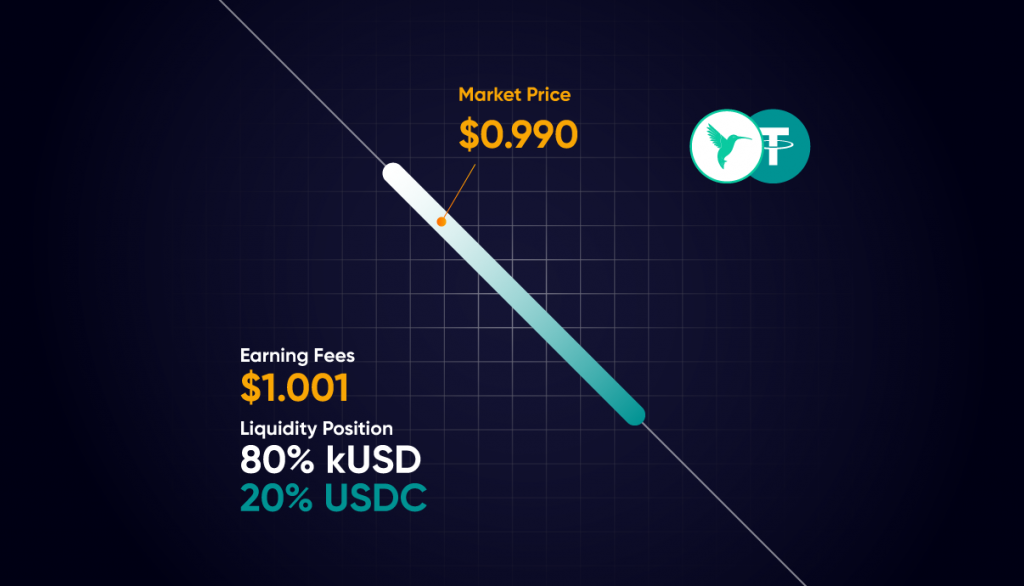

Active liquidity

This feature allows Liquidity providers to have more control over provided liquidity. How it works:

1) By providing liquidity, a user sets up a price range for his tokens.

2) If the price of assets moves outside of this price range, the liquidity is effectively removed from the pool and stops earning fees.

3) Liquidity tokens are converted to the cheapest asset and moved to a liquidity provider.

4) A liquidity provider can wait until the token price is moved to the pre-established range or add liquidity again with the new price range.

Example:

Bob added liquidity to the TEZ/USDT pool and set up a TEZ price range between $0.9-1.15 by using the Active liquidity feature. If the TEZ price becomes less than $0.9 – all liquidity automatically converts to TEZ. If the TEZ price increases and becomes more than $1.15 – all Bob’s liquidity converts to USDT.

It’s also possible a case when a liquidity pool doesn’t have enough liquidity in a specific price range. This event creates a lucrative opportunity for a liquidity provider because if he adds liquidity to this range, he gets almost all trading fees from swaps in this price range.

By using the Active liquidity feature, liquidity providers may set up different marketing strategies:

– focus on narrow but most popular price ranges;

– find the less likely but more profitable ranges;

– constant price range updates to follow the marketing trends;

– etc.

We have shared just a part of further QuipuSwap updates. In our following article, we detailed other planned features, including custom fees, non-fungible liquidity, and advanced oracles. Read Part Two