As a part of our effort to broaden the scope of DeFi instruments present in the ecosystem, we have launched a Curve-like Stable DEX on Tezos. Apart from the main Stable DEX features, we are introducing some new farming opportunities. In this article, we will explain some intricacies of the project.

What is a Stable DEX?

Some traders prefer decentralized exchanges for their decentralized approach and a wider variety of assets. In the Tezos ecosystem, DEXes are instrumental and facilitate the majority of transactions.

Stable DEX is a DEX with a somewhat niche mission. It only hosts pools of assets that have the same price dynamics. For example, USD-pegged tokens are traded against other USD-pegged tokens, while wrapped BTC are traded against their counterparts.

Why is a Stable DEX useful?

There are a number of advantages a Stable DEX provides for swapping between equal value assets.

When swapping tokens with similar prices, traders expect less volatile rates and Stable DEX offers deals with very low slippage. Additionally, much less liquidity is required to maintain good rates in a pool and at the same time, larger swaps incur much lesser price impact.

Needless to say, such platforms are invaluable for arbitrage.

QuipuSwap Stable DEX

QuipuSwap Stable Dex currently hosts three liquidity pools:

- uUSD/kUSD/USDtz

- uBTC/tzBTC

- uUSD/USDC.e

Providing liquidity on Stable DEX is not much different from providing liquidity to the usual tez/token or token/token pools on QuipuSwap. A detailed guide can be found here

Removing liquidity is explained here:

The important difference here is that some pools may contain more than two assets.

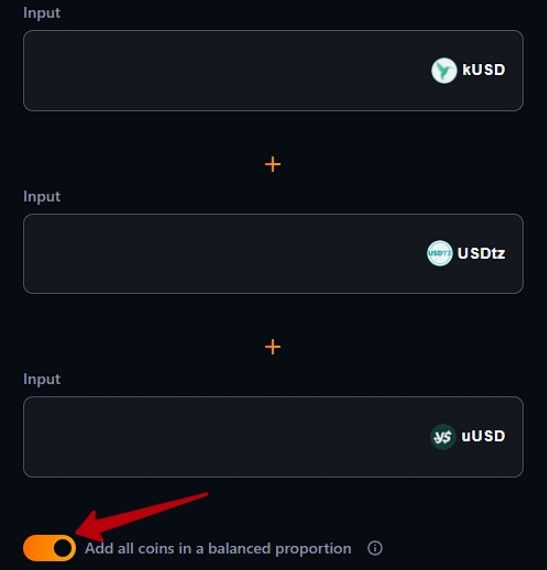

We have provided a special tool that will automatically add all assets in a balanced proportion.

This slider, when turned on, will automatically match input balances for all selected assets according to the current asset ratio in the pool.

Note that turning off this switch and making QuipuSwap rebalance your stake under-the-hood incurs an additional 0.15% fee.

With time we plan to allow users to create their own equal-value token pools, just like they can already create custom pools on QuipuSwap.

Stable DEX farms

QuipuSwap launched three new farms, mirroring each Stable DEX liquidity pool.

By staking LP tokens of Stable DEX pools users earn QUIPU rewards. This should incentivize Stable DEX liquidity growth.

In the future, we also intend to offer an extra route of incentivizing QUIPU holders by staking QUIPU in the Stable DEX pools for a cut of fee rewards (read about Stable DEX fees below).

Every Fee Explained

QuipuSwap Stable DEX offers four minor fees. For the sake of transparency, in this section, we will explain each one of them.

Liquidity providers fee (0.07%) – the usual fee collected in favor of the pool’s liquidity providers. These assets remain in the liquidity pool and are distributed in proportion to the stake size once the liquidity provider withdraws his stake.

Interface fee (0.005%) – this fee exists to incentivize the members of the Tezos ecosystem to integrate Stable DEX into their interface. It is collected by the parties who integrate Stable DEX into their UI whenever a swap happens via their platform.

QUIPU stakers fee (0.03%) – QUIPU holders will stake their QUIPU in a Stable DEX pool and gather fees in proportion to their stake. Before these QUIPU farms are launched, this fee will be distributed to liquidity providers.

Dev fee (0.045%) – This fee goes directly to the QuipuSwap developers’ team. Since QuipuSwap is no longer sponsored by Tezos Foundation, this fee is introduced to keep the project afloat.

Follow us on Social media and never miss an update:

Twitter: https://twitter.com/YupanaFinance

Telegram: https://t.me/MadFishCommunity

Discord: https://discord.gg/pcTfP77JV9

Reddit: https://www.reddit.com/r/MadFishCommunity

Facebook: https://www.facebook.com/madfishofficial

LinkedIn: https://www.linkedin.com/company/mad-fish-solutions/

Our blog: https://madfish.solutions/blog