Meet Temple Router – the major Temple Wallet update that brings smart routing to find the best deal conditions.

Temple earned notoriety as the main Tezos Defi wallet, with over 140,000 users actively using the in-app swap tool. To improve user experience and make operations more profitable, we have implemented transaction routing.

Let’s look at how Temple Router helps in the execution of trades:

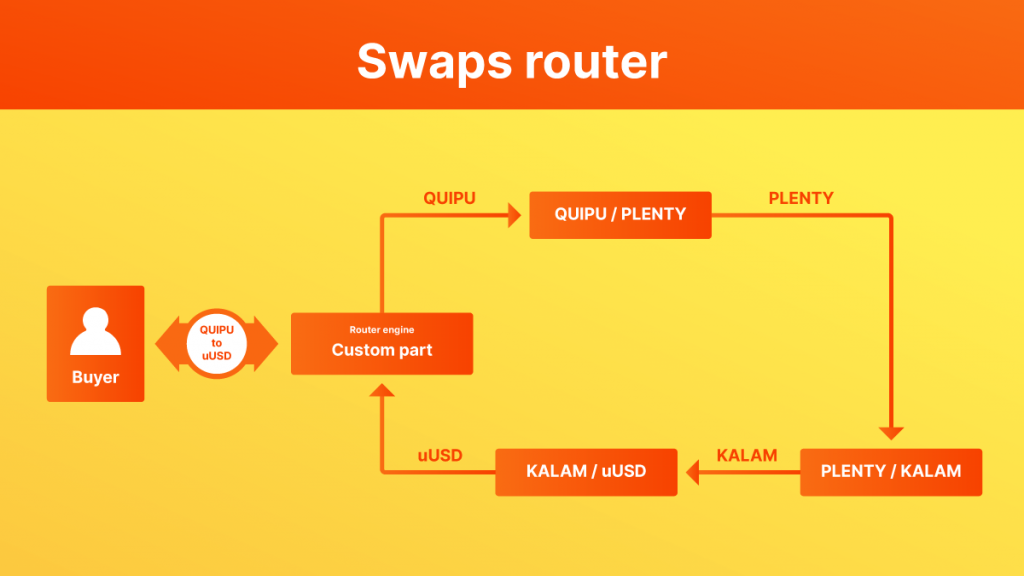

Acting along similar lines to 1Inch and Uniswap Router, Temple Router can check prices across several DEXs and ensure users are always given the best rate for swaps. From now on, Temple routes transactions through multiple protocols and liquidity pools to achieve a better exchange rate than when swapping through a single pool on a DEX.

The maximum number of pools in each routing trade cannot exceed three. This limitation is required to control the risk of slippage due to the use of different protocols and pairs. In addition, the use of a router will help solve the problem of conducting swaps through pools with low liquidity, executing transactions through several pools.

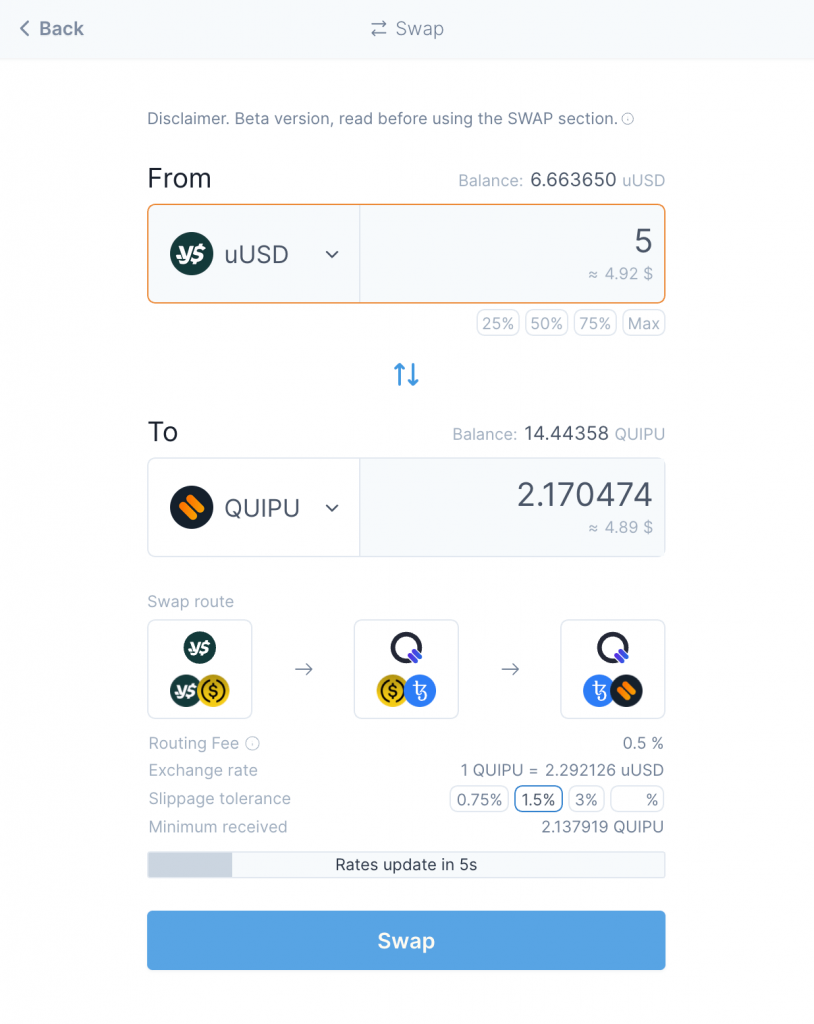

Users can track the exchange transaction path in the new Swap Route field, where they will have access to information about DEXs and the liquidity pools through which the transaction will pass. The routing fee for each swap is 0.5%.

Pay attention: We strongly recommend sending a transaction to the network at the start of a new block and rate changes. Otherwise, the transaction may fail. The time until a new block is ready and rate changes is indicated above the “Swap” button.

The main differences in exchange rates can be noticed with large trades. However, users will still benefit more from using routing in their usual daily swaps than under the old swaps model.

Currently, Temple Router supports four DEX protocols and their liquidity pools. Temple swap engine will look for the most profitable exchange path:

- QuipuSwap;

- Plenty DEX;

- Liquidity Baking;

- Youves CFMM (Flat Curve Constant Function Market Maker).

In the future, we’re planning to add even more protocols and improve other aspects of the router.

To see the latest updates, join our communities on Telegram and Discord or subscribe to our email newsletter on the website.